Average accounts receivable calculation

The debt to equity ratio can be misleading unless it is used along with industry average ratios and financial information to determine how the company is using debt and equity as compared to its industry. Companies that are heavily capital intensive may have higher debt to equity ratios while service firms will have lower ratios. A debtor’s turnover ratio of 6 times means that on an average; the debtors buy and payback 6 times in a year. So we can assume that 6 times a year means once every two months which is nothing but the average collection period of 60 days. The credit sales get converted to cash 60 days from the date of sale on an average basis.

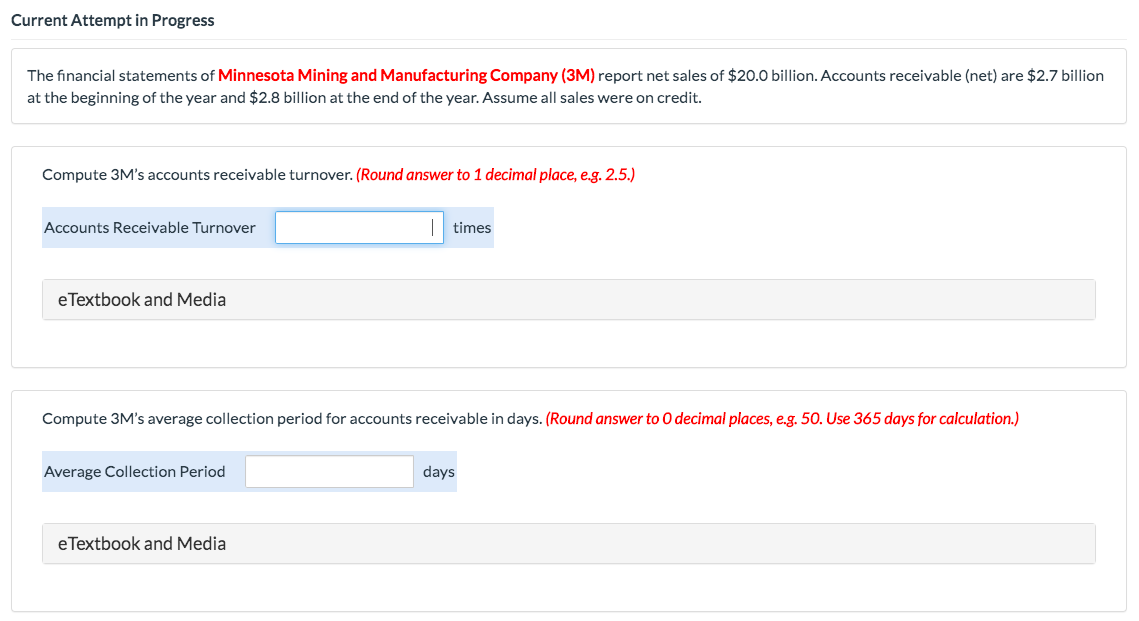

Accounts Receivable Turnover

However, an ongoing evaluation of the outstanding collection period directly affects the organization’s cash flows. The average collection period represents the average number of days between the date a credit sale is made and the date the purchaser pays for that sale. A company’s average collection period is indicative of the effectiveness of its accounts receivable management practices. Businesses must be able to manage their average collection period in order to ensure they operate smoothly. The average collection period is the average number of days between 1) the dates that credit sales were made, and 2) the dates that the money was received/collected from the customers.

Debtors turnover ratio, also called accounts receivable turnover ratio, is a ratio that is used to gauge the number of times a business is able to convert its credit sales to cash during a financial year. The collection period is the time taken by the company to convert its credit sales to cash. Both these ratios indicate the efficiency factor of the company in collecting receivables from its debtors and the speed at which they are able to do it. These two ratios are largely used to indicate the liquidity position of the company along with its efficiency with which operates. It also reflects the power the company has to dictate credit terms.

The debt to equity ratio can be used as a measure of the risk that a business cannot repay its financial obligations. A high debt to equity ratio indicates a business uses debt to finance its growth. Companies that invest large amounts of money in assets and operations (capital intensive companies) often have a higher debt to equity ratio.

Most companies try to decrease the average payment period to keep their larger suppliers happy and possibly take advantage of trade discounts. An average collection period shows the average number of days necessary to convert business receivables into cash. The degree to which this is useful for a business depends on the relative reliance on credit sales by the company to generate revenue – a high balance in accounts receivable can be a major liability. Debt and equity compose a company’s capital structure or how it finances its operations.

What Is the Average Collection Period?

For lenders and investors, a high ratio means a riskier investment because the business might not be able to produce enough money to repay its debts. The debt to equity ratio is a measure of a company’s financial leverage, and it represents the amount of debt and equity being used to finance a company’s assets. It’s calculated by dividing a firm’s total liabilities by total shareholders’ equity. Companies may also compare the average collection period to the credit terms extended to customers. For example, an average collection period of 25 days isn’t as concerning if invoices are issued with a net 30 due date.

The formula for the collection ratio is to divide total receivables by average daily sales. A lengthy period during which receivables are outstanding represents an increased credit risk for the seller, and also requires a larger working capital investment to fund the underlying inventory that was sold. However, a business may deliberately allow a long collection period in order to service higher credit-risk customers to which its competitors are unwilling to sell. So ideally a higher debtor’s turnover ratio and lower collection period are what a company would want. A lower collection period would mean a faster conversion of credit sales to cash.

Here are six often overlooked steps you can take to reduce your average accounts receivable days outstanding. Debtor’s turnover ratio and average collection period form an important aspect of working capital management.

What does a high average collection period mean?

The average collection period is calculated by dividing the average balance of accounts receivable by total net credit sales for the period and multiplying the quotient by the number of days in the period.

To find the RT, divide the total of credit sales by the accounts receivable, which are the sales that have not yet been paid for. Now calculate the average collection period by dividing the days in the relevant accounting period by the RT. The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies calculate the average collection period to make sure they have enough cash on hand to meet their financial obligations. The collection ratio is the average period of time that an organization’s trade accounts receivable are outstanding.

- Debtors turnover ratio, also called accounts receivable turnover ratio, is a ratio that is used to gauge the number of times a business is able to convert its credit sales to cash during a financial year.

- The collection period is the time taken by the company to convert its credit sales to cash.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

This ratio along with inventory turnover ratio and creditor’s turnover ratio can help a firm design an efficient working capital cycle. These ratios along with the liquidity ratios like current and the quick ratio can help banks analyze the liquidity situation of the company and the efficiency with which it manages its receivables. This will also help in bringing down the bad debts for the company. The collection period for a specific bill is not a calculation, but rather is simply the amount of time between the sale and the payment of the bill. Calculating the average collection period for a segment of time, such as a month or a year, requires first finding the receivable turnover, or RT.

Because Accounts Receivable are considered current assets, it’s good to know how much potential income the receivables are worth. It is also a good way to determine the ratio of cash-to-credit customers. This figure is important for a company that is considering seeking outside financing.

One can say that lower the average collection period higher the efficiency of the company in managing its credit sales and vice versa. Higher debtor’s turnover ratio indicates faster turnaround and reflects positively on the liquidity of the company.

How do you calculate average collection period?

One formula for calculating the average collection period is: 365 days in a year divided by the accounts receivable turnover ratio. An alternate formula for calculating the average collection period is: the average accounts receivable balance divided by the average credit sales per day.

The average collection period is also referred to as the days’ sales in accounts receivable. It measures the number of days that it takes a firm on average to collect their debts. Firms often allow a period of credit to their customers, but it is important for their cash flow that they do not take too long to collect their debts.

It’s considered an important financial metric because it indicates the stability of a company and its ability to raise additional capital to grow. Management has decided to grant more credit to customers, perhaps in an effort to increase sales. This may also mean that certain customers are being allowed a longer period of time before they must pay for outstanding invoices. This is especially common when a small business wants to sell to a large retail chain, which can promise a large sales boost in exchange for long payment terms.

DefinitionThe average payment period (APP) is defined as the number of days a company takes to pay off credit purchases. It is calculated as accounts payable / (total annual purchases / 360). As the average payment period increases, cash should increase as well, but working capital remains the same.

The long-term debt to equity ratio shows how much of a business’ assets are financed by long-term financial obligations, such as loans. To calculate long-term debt to equity ratio, divide long-term debt by shareholders’ equity. These considerations will greatly impact the debt to equity ratio of these two companies. The debt to equity ratio is a simple formula to show how capital has been raised to run a business.

Definition of Average Collection Period

The faster collection would keep the company having the cash to pay off its creditors and thereby reduce the working capital cycle for better working capital management. The accounts receivable turnover ratio measures a company’s effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is converted to cash. Finally, if a company had a lot of account receivables, it might be worth considering offering discounts to customers who pay off their accounts in 30 days or less. For example, the company could offer a 2 percent discount, if the balance is settled in 20 days.

As a small business owner, I recognize the importance of timely payments from my customers. Late payments are frustrating, and follow-up can be time-consuming. Yet it is important to have a process in place for dealing with late payments.