Audit Procedures: Definition

Audit Assertions are claims made by the management in their financial statements.These claims may be implicit (not directly stated but implied) or explicit (directly stated). You know, it is the responsibility of management to provide financial statements to external auditors.

Can audit procedures be revised during the substantive testing?

The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions.

What are the five audit assertions?

Definition. Audit Assertions are the implicit or explicit claims and representations made by the management responsible for the preparation of financial statements regarding the appropriateness of the various elements of financial statements and disclosures.

For example, auditors will determine if the assets and liabilities found in the balance sheet exist. They confirm that the assets legally belong to the company and the liabilities properly attach to the firm. They also check restrictions on the use of the assets, and whether those restrictions must be disclosed. Auditors compare figures from the current balance sheet with numbers from the previous period balance sheet. If there are significant differences between the financial statements, auditors dig deeper into the records to try to find a satisfactory reason for the change.

Example

Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud. As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. The assertion of accuracy and valuation is the statement that all figures presented in a financial statement are accurate and based on proper valuation of assets, liabilities and equity balances.

This document will tell the auditor the terms and conditions of the loan, as well as the proceeds and repayment terms. The auditor can then reconcile these amounts into the company’s bank statements, which are audited as part of cash procedures. Of these assertions, I believe existence, accuracy, and cutoff are most important. The audit client is asserting that the cash balance exists, that it’s accurate, and that only transactions within the period are included. Financial statements are written records that convey the business activities and the financial performance of a company.

However, the auditor should determine that the audit procedures selected are suitable for accomplishing the audit objective related to the assertion. For example, confirmation of accounts receivables provides valid evidence relating to the assertion of existence. However, the fact that the client’s customers indicate that the amount on the face of the confirmation is correct provides little, if any, evidence that payment is assured. Valuation can be supported by the process of aging the current accounts receivable to evaluate the adequacy of the allowance account.

Management assertions in auditing

In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements. As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors also scrutinize the balance sheet for special transactions, one-time significant changes or other conditions with material effects on the figures. For example, they take note of any ongoing litigation that may impact the company’s assets, liabilities or revenues. They pay special attention to any extraordinary transactions that cause significant changes to company profits.

- The concept of materiality allows the auditor to support the statement that a sufficient number of transactions–as opposed to all transactions–have been recorded.

They also highlight changes to the accounting method that the company uses. This information helps business owners prepare for the next period because it separates those special circumstances that are unlikely to be repeated. Auditors examine whether the figures assigned to the various headings under the balance sheet are accurate. They compare the information in the financial statement with third-party documentation.

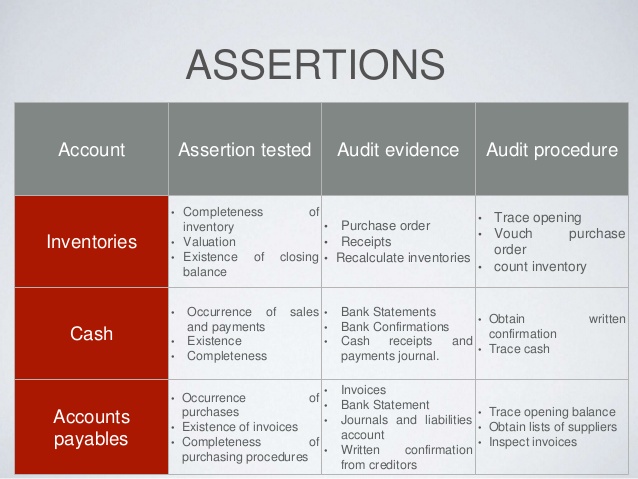

Auditors use different audit procedures to test management’s assertions about a company’s financial statements. The techniques employed depend upon the strength of the evidence desired, requirements of generally accepted auditing standards and the nature of the accounting being audited. Understanding some common audit procedures and and types of audit evidence can help you reduce uncertainty among your employees as your company completes its audit.

For example, if the value of accounts payable has seen a marked increase, the auditors will try to determine the reasons for this increase. They will consider whether these reasons make sense in the context of the business. by Julie Davoren A balance sheet audit tests the validity of a company’s financial statements and internal controls.

For example, any statement of inventory included in the financial statement carries the implicit assertion that such inventory exists, as stated, at the end of the accounting period. The assertion of existence applies to all assets or liabilities included in a financial statement. On the surface, this assertion appears to be one of the least troublesome.

Financial statements include the balance sheet, income statement, and cash flow statement. Off statement financing has frequently resulted in an entity’s receiving the use of an item without measuring or disclosing the transaction in the statements.

The presence of tangible assets in a retail client’s possession is evidence that the asset has been acquired. An invoice from a vendor and a receiving report from the warehouse supervisor or receiving clerk are examples of documents that are indicative that transactions have occurred and should be recorded. The direction of the effort is from the asset or from the externally created documents to the entries in the journal, to the ledger, and to the balance.

Internal Audits

Management wants to tell the auditors that their revenues, as well as expenses, occurred actually and are complete, accurate, properly classified and recorded in the correct period. similarly, they also have certain audit assertions about the balance sheet and disclosure.We are going to cover each of them.

The concept of materiality allows the auditor to support the statement that a sufficient number of transactions–as opposed to all transactions–have been recorded. Testing to support completeness originates with externally generated documentation that a transaction has occurred.

One of the most common audit procedures is the examination of documentation. This audit procedure involves requesting supporting documentation for business transactions and verifying the inputs and outputs of the documentation. For example, to test a loan balance that the client owes to a bank, the auditor will request a copy of the signed promissory note.