Assets, Liabilities, and Equity–It All Equals Out

The amount of equity the owner has in the business is an important yardstick used by investors to evaluate the company. Many times, it determines the amount of capital they feel they can safely invest in the business.

Intangibles such as goodwill are also considered to be assets. Your net worth equals your total liabilities subtracted from your total assets. (For help calculating your net worth, tryPersonal Capital, a free money-management app). Because your car is an asset, include it in your net worth calculation. If you have a car loan, include it as a liability in your net worth calculation.

What are Total Assets?

A capital asset is defined to include property of any kind held by an assessee, whether connected with their business or profession or not connected with their business or profession. It includes all kinds of property, movable or immovable, tangible or intangible, fixed or circulating. Current liabilities are financial obligations of a business entity that are due and payable within a year.

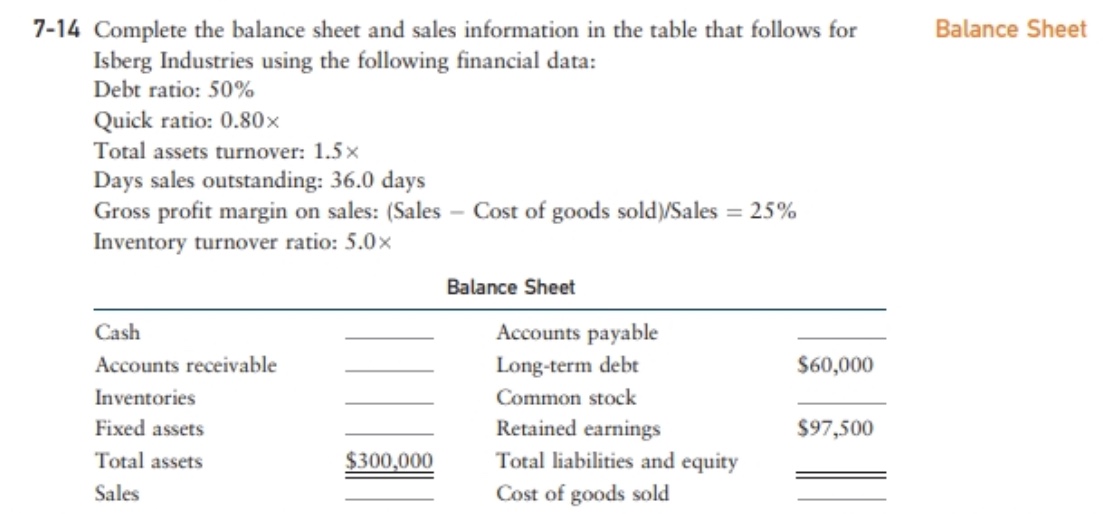

A balance sheet is one of the fundamental financial statements used by most businesses. It details the company’s financial standing at a particular moment. The balance sheet reports the assets – property and rights to property – belonging to the company, such as equipment and accounts receivable. The balance sheet also shows the liabilities – debts or obligations – owed to others, such as accounts payable and notes payable. The balance sheet highlights the financial position of a company at a particular point in time (generally the last day of its fiscal year).

Total assets

If the business has more assets than liabilities – also a good sign. However, if liabilities are more than assets, you need to look more closely at the company’s ability to pay its debt obligations. Every company must report their total asset value following the same standards as developed by generally accepting accounting periods, regardless of company size or classes of assets on hand. To comply with the basic accounting equation, total assets must equal the sum of total liabilities and total stockholders’ equity combined.

For example, if one company buys a computer to use in its office, the computer is a capital asset. If another company buys the same computer to sell, it is considered inventory.

Also called the “Acid Test”, the Debt to Equity ratio measures the ability of the company to use its current assets to retire current liabilities. It provides an indication of how the firm finances its assets. Financially healthy companies generally have a manageable amount of debt (liabilities and equity). If the debt level has been falling over time, that’s a good sign.

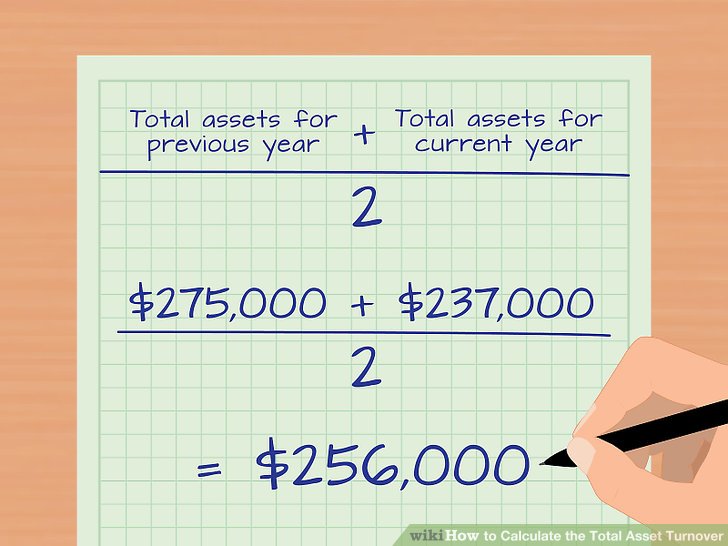

What is the formula for total assets?

Total assets refers to the total amount of assets owned by a person or entity. Assets are items of economic value, which are expended over time to yield a benefit for the owner. If the owner is a business, these assets are usually recorded in the accounting records and appear in the balance sheet of the business.

- The balance sheet reports the assets – property and rights to property – belonging to the company, such as equipment and accounts receivable.

- A balance sheet is one of the fundamental financial statements used by most businesses.

- It details the company’s financial standing at a particular moment.

The total asset value will change during each reporting period, as depreciation or appreciation is recorded for an asset. Also, a change in inventory volume, accounts receivables, cash on hand, prepaid expenses, or short-term investments will affect the total asset value, as well. A second important concept to learn is the order in which total assets are reported on the balance sheet. Total assets are listed on the balance sheet in order of liquidity. Liquidity is a term used to refer to how quickly an asset can be turned into cash.

This financial statement is so named simply because the two sides of the Balance Sheet (Total Assets and Total Shareholder’s Equity and Liabilities) must balance. Total assets are the sum of all current and noncurrent assets that a company owns. The total asset figure is based on the purchase price of the listed assets, and not the fair market value.

Examples of Total Assets

Cash is located at the very top of the balance sheet under the current assets classification. Cash is followed closely by accounts receivables, short-term investments, prepaid expenses, and inventory. In some income tax systems (for example, in the United States), gains and losses from capital assets are treated differently than other income.

One of the most important things to understand about the balance sheet is that it must always balance. Total assets will always equal total liabilities plus total equity. Thus, if a company’s assets increase from one period to the next, you know for sure that the company’s liabilities and equity increased by the same amount. Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art. For businesses, a capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation.

A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources. Once the liabilities have been listed, the owner’s equity can then be calculated. The amount attributed to owner’s equity is the difference between total assets and total liabilities.

A balance sheet is a summary of all of your business assets (what the business owns) and liabilities (what the business owes). At any particular moment, it shows you how much money you would have left over if you sold all your assets and paid off all your debts (i.e. it also shows ‘owner’s equity’). Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded.

The United States system defines a capital asset by exclusion. The next section on the balance sheet is for noncurrent assets. Examples of noncurrent assets include real estate, machinery, and land. These noncurrent assets are also called plant, property, and equipment. Other things that are included as noncurrent assets are intangible assets, such as product trademarks and/or web domain names.

Sale of non-capital assets, such as inventory or stock of goods held for sale, generally is taxed in the same manner as other income. Capital assets generally include those assets outside the daily scope of business operations, such as investment or personal assets.

As with any and all assets, and though deprecation and appreciation may occur, the valuation of each asset is recorded on the balance sheet as the assets purchase value. Once all assets have been classified and listed in their appropriate spots on the balance sheet, the sum of all their valuations is added together to get total assets. The balance sheet is sometimes called the statement of financial position since it shows the values of the net worth of the entity.

Notice on example A, assets are on the top of the balance sheet, and liabilities and stockholders’ equity is on the bottom. On example B, assets are on the left side and liabilities and stockholders’ equity are on the right. Regardless of whether the balance sheet is formatted with a top-to-bottom or side-to-side look, the premise is the same. The total assets calculation must be equal to the total liabilities and stockholders’ equity calculation.

You can find entity net worth by removing liabilities from total assets. An asset is anything of monetary value owned by a person or business.