Are credit sales an asset or liability?

When a piece of merchandise or inventory is sold on credit, two business transactions need to be record. First, the accounts receivable account must increase by the amount of the sale and the revenue account must increase by the same amount.

The accrual basis of the statements means credit and not-yet-received accounts receivable must be removed from the accounts receivable column to extract cash sales from the statement. Cash sales may be calculated from balance sheets, income statements and retained earnings statements. For statements of cash flows, cash sales must be figured out to create the statement. Credit sales interact with a balance sheet through the customer receivables account, which is a short-term asset. Along with merchandise and cash, accounts receivable represent resources a business will use in the next 12 months.

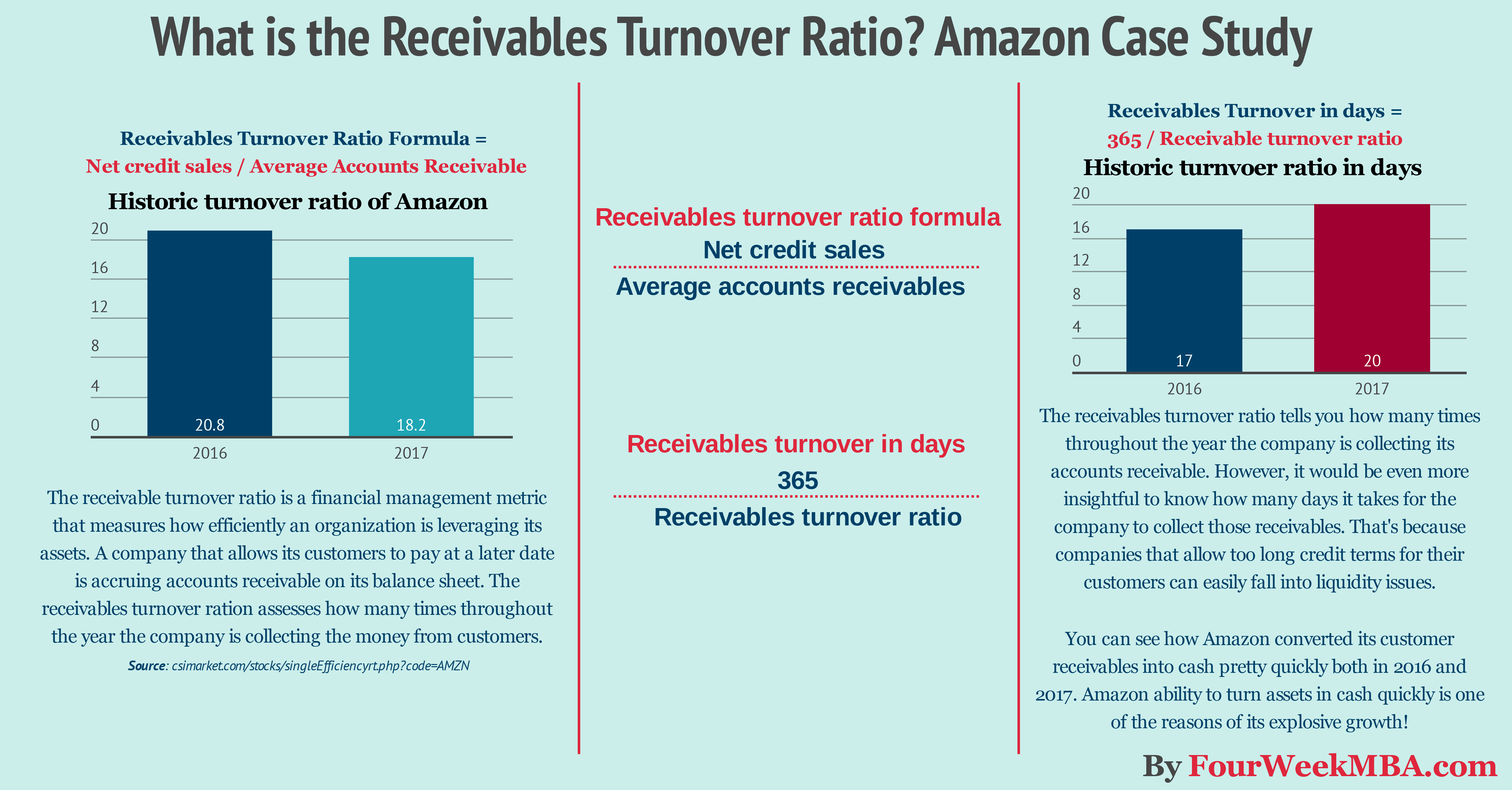

What is the Accounts Receivable Turnover Ratio?

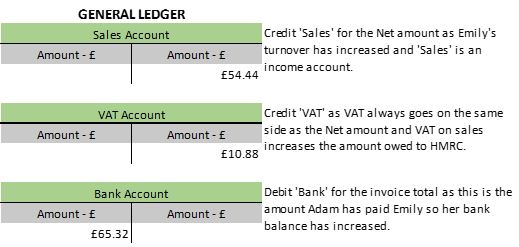

At the time of the credit sales, businesses record accounts receivable as a debit and sales as a credit in the amount of the sales revenue. Instead of receiving cash from the sales, companies agree to delayed payments by holding customers’ accounts receivable. Because no cash changes hands, for any returned sales from customers, businesses debit sales returns to reduce earlier sales, and credit accounts receivable to arrive at the reduced outstanding balance. The completed-contract method should be used only if percentage-of-completion is not applicable or the contract involves extremely high risks.

In principle, this transaction should be recorded when the customer takes possession of the goods and assumes ownership. Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded.

This means that for every dollar Apple generated in sales, the company generated 38 cents in gross profit before other business expenses were paid. A higher ratio is usually preferred, as this would indicate that the company is selling inventory for a higher profit. Gross profit margin provides a general indication of a company’s profitability, but it is not a precise measurement.

So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. Cash sales information can be found in the “accounts receivable” column of some financial statements. However, some accounts receivable don’t represent cash sales, but rather cash owed by customers. Most American financial statements track receivables on an accrual basis, meaning that transactions are recorded when the sale is made, not when cash is received.

Businesses use the allowance account to ensure the proper carrying value of accounts receivable. Credit sales may be used for retaining customers and attracting new ones, but they may also add complexities to record keeping. Compared with cash sales and their simple recording, credit sales need to record not only initial sales but also potential credit losses and eventual cash collections. When credit sales to some customers become uncollectible, businesses making the sales incur a bad debt expense.

Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon. To properly record credit sales, businesses must record the bad debt expense from uncollectible accounts receivable in the period when the credit sales occur. The bad debt expense is debited as part of the overall cost of making the credit sales, and the allowance for doubtful accounts is credited as a reduction to the total amount of accounts receivable.

Under this method, revenues, costs, and gross profit are recognized only after the project is fully completed. Thus, if a company is working only on one project, its income statement will show $0 revenues and $0 construction-related costs until the final year. However, expected loss should be recognized fully and immediately due to conservatism constraint.

How do you calculate net credit sales?

Net credit sales. January 03, 2019. Net credit sales are those revenues generated by an entity that it allows to customers on credit, less all sales returns and sales allowances. Net credit sales do not include any sales for which payment is made immediately in cash.

This makes sense, because a decrease in accounts receivable means more money coming in corporate coffers. Credit sales flow into the top-line section of a statement of profit and loss – the other name for an income statement, or statement of income.

The unearned income is deferred and then recognized to income when cash is collected. For example, if a company collected 45% of total product price, it can recognize 45% of total profit on that product. The gross margin represents the amount of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services sold by the company. It is wise to compare the margins of companies within the same industry and over multiple periods to get a sense of any trends. The gross profit is the absolute dollar amount of revenue that a company generates beyond its direct production costs.

This entry records the amount of money the customer owes the company as well as the revenue from the sale. Credit sales, when your business allows a customer to purchase something using a line of credit, is considered an asset because it has a direct impact on your accounts (or notes) receivable. The accounts receivable aging report itemizes all receivables in the accounting system, so its total should match the ending balance in the accounts receivable general ledger account. The accounting staff should reconcile the two as part of the period-end closing process. If a company offers customers a discount if they pay early and they take advantage of the offer, then they will pay an amount less than the invoice total.

- On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses.

- Credit sales are thus reported on both the income statement and the company’s balance sheet.

Video Explanation of Different Accounts Receivable Turnover Ratios

Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS). The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services. In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved. A company’s revenue usually includes income from both cash and credit sales. Cost of sales does not include indirect expenses such as distribution costs and marketing costs.

Accounts Receivable Turnover Ratio Template

Profit margin is a percentage measurement of profit that expresses the amount a company earns per dollar of sales. If a company makes more money per sale, it has a higher profit margin. Gross profit margin and net profit margin, on the other hand, are two separate profitability ratios used to assess a company’s financial stability and overall health.

To record regular, on-time cash collections, businesses debit the cash account and credit accounts receivable to remove collected customer accounts. To record early cash collections, businesses debit both the cash account and the account of sales discounts as an expense and credit accounts receivable to reduce the outstanding balance. Installment sales method allows recognizing income after the sale is made, and proportionately to the product of gross profit percentage and cash collected calculated.

Credit sales are thus reported on both the income statement and the company’s balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses. The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory. A change is reported to stockholder’s equity for the amount of the net income earned.

For example, a company receives an annual software license fee paid out by a customer upfront on the January 1. So, the company using accrual accounting adds only five months worth (5/12) of the fee to its revenues in profit and loss for the fiscal year the fee was received. The rest is added to deferred income (liability) on the balance sheet for that year.

If there are no sales of goods or services, then there should theoretically be no cost of goods sold. Instead, the costs associated with goods and services are recorded in the inventory asset account, which appears in the balance sheet as a current asset. Also, there may be production-related expenses (such as facility rent) even when there is no production at all, as would be the case when there is a union walkout. In these cases, it is possible for there to be a cost of goods sold expense even in the absence of sales.

A credit sale doesn’t directly affect a statement of cash flows because it involves no monetary element. However, a liquidity report – an identical term for a statement of cash flows – prepared under the indirect method touches on credit sales and accounts receivable. To calculate cash flows from operating activities, financial managers add a decrease in customer receivables back to net income, doing the opposite for an increase in the accounts’ value.

Long-term assets are those that will not be liquidate for at least 52 weeks. Examples include real property, production equipment, manufacturing plants and computer gear, all of which go under the “property, plant and equipment” section of a balance sheet.

BUSINESS PLAN

In the top-line category you also find merchandise expense, also known as cost of sale or cost of goods sold. Total sales minus merchandise expense equals gross profit, a measure of top-line growth. Don’t mistake this for the bottom line, which is the net performance result an organization publishes at the end of a given period – say, a month or fiscal quarter. Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet.

Thus, an alternate rendering of the gross margin equation becomes gross profit divided by total revenues. As shown in the statement above, Apple’s gross profit figurewas $88 billion (or $229 billion minus $141 billion). The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. The gross margin result is typically multiplied by 100 to show the figure as a percentage. The COGS is the amount it costs a company to produce the goods or services that it sells.

AccountingTools

It appears on the income statement and is deducted from the sales revenue for the calculation of gross profit (or gross margin). Since issuing an invoice does not involve any change in cash, there is no record of accounts receivable in the accounting records. Businesses specify in the terms of credit sales when customers must make their cash payments. The terms may also allow customers to make early cash payments for a discount.

The accountant needs to eliminate this residual balance by charging it to the sales discounts account, which will appear in the income statement as a profit reduction. Businesses sometimes make credit sales knowing that some accounts may eventually become uncollectible. In the period when the credit sales occur, companies may estimate the amount of potential losses from the credit sales based on past experience and current customer credit evaluation. The estimated losses are recorded in “allowance for doubtful accounts,” a negative account to accounts receivable.