Answers about Cancelled Checks

How Do Mortgage Lenders Check and Verify Bank Statements?

The main use of a canceled check is to serve as a payment record, and it is used in disputes to prove money has changed hands. Many banks no longer return the original check with your bank statement, so you’ll likely only have access to a copy. Canceled checks are becoming a thing of the past as recent federal regulations promote more use of electronic processing of check images rather than paper originals.

When the check finally clears the account of the payor or the person who wrote it, it’s considered canceled. In short, a canceled check means the clearing process has finished, and the check cannot be reused. As a result, canceled checks can be used as proof of payment.

How long it takes a check to clear depends on the amount of the check, your relationship with the bank, and the standing of the payer’s account. Wait a few days before contacting your bank about holds on deposited checks. Print If you have a Chase checking account, you can view images of cleared checks or deposit slips using the Chase Online® imaging service. If possible, placing a stop payment online can be easier, faster and cheaper than doing so in person. Since your bank already has most of your information attached to your account, it is much easier than trying to do it in person.

These canceled checks can be a valuable tool in your control environment as it allows for a review of the actual checks in the event that someone fraudulently writes a check. Banks usually charge a fee of up to $30.00 for canceling a check. The cost can vary, depending on how the cancel request is made or the type of client the payer is.

Some banks will also charge the check writers less if they hold certain types of accounts with the bank. Most banks do not charge a fee for getting copies of canceled checks through your online account, so this is the way to go if you want to avoid fees. Accounts that have no or little history may automatically qualify for holds on all check deposits until the time that the bank feels you have solidified your relationship with it.

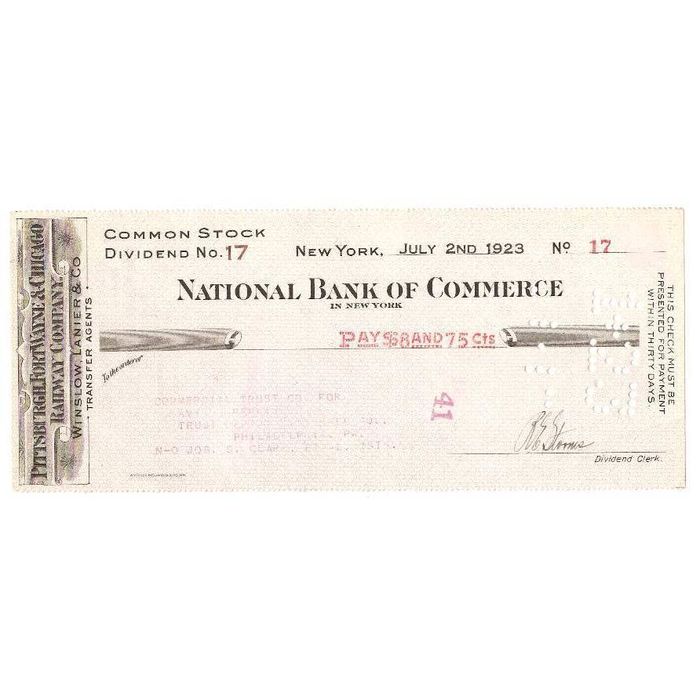

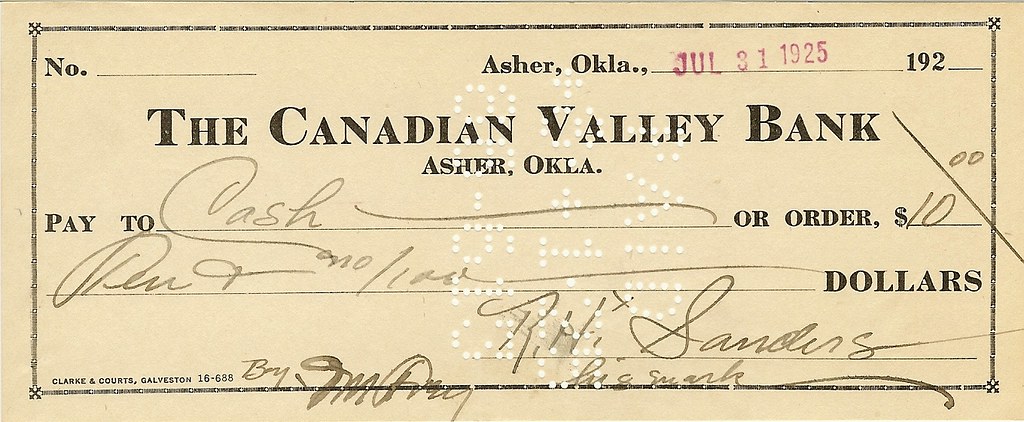

Example of a Canceled Check

When the payee’s bank receives the check, your signature authorizes the bank to transfer funds from your account to the recipient’s account. Usually it takes a couple of business days for a check to clear once it’s been deposited. Other financial vehicles of payment that can be canceled include money orders and electronic payments. You cannot cancel a cashier’s check since the funds are guaranteed to be paid by the bank. Debit card transactions also cannot be canceled, but a chargeback can be requested from the financial institution that issued the card.

Accounts that have negative history—that is, accounts that frequently bounce payments or go into overdraft—may also have checks held. A cashier’s check, on the other hand, is drawn directly on the bank that issued the check and not on your account. You may need to use a cashier’s check when you are making a large payment, such as a security deposit on an apartment. You pay the bank the sum needed and a small service fee of $10 or so, and the bank guarantees the funds to the payee. In most cases, banks must honor a cashier’s check when it is presented, and a stop payment is not available.

Instead, they made the images of these canceled checks available online. They also offer the option to receive a printed copy of the cleared checks with your bank statement, though many charge an additional fee for this.

If your business accepts checks from customers regularly, contacting banks for every check is not practical. Automated check verification services can help you figure out if you’re likely to get paid, but they don’t necessarily verify recent account balances. Instead, those services flag accounts and people who have a history of writing bad checks—and that’s useful information. Some services even guarantee payment if they fail to alert you to a bad check.

- A canceled check is a check that you wrote to a vendor or employee that they in turn presented to their bank for payment and has cleared your checking account.

By doing this, they help you avoid incurring any charges—especially if you use the funds right away. Your personal check contains your name, your account number, a bank routing number, a check number, the payee’s name and the amount payable.

By law, financial institutions must keep canceled checks or the capacity to make copies of them for seven years. In most cases, customers who utilize online banking can also access copies of their canceled checks via the web. While many banks charge for paper copies of canceled checks, customers can typically print copies from the bank’s website for free. Instead, a special scanner creates a digital impression of the front and back of the check, which it sends to the other bank.

How to Get a Copy of Canceled Checks

The number of days the bank holds these checks depends on your relationship with the institution. You’re more likely to get the money immediately—or within fewer than 10 days—if you have a healthy account balance and no history of overdrafts. A history of overdrafts and low account balances may mean you’ll have to wait the full 10 days to receive the money. It usually takes about two business days for a deposited check to clear, but it can take a little longer—about five business days—for the bank to receive the funds.

Back in the old days before modern computer systems, bank actually mailed cancelled checks back to you every month with your bank statement. Now banks don’t do that because of the shipping and processing costs. Instead, banks usually print copies of the canceled checks on the back of each bank statement. It bears mentioning again that large deposits may come with a longer hold time. Some banks may hold checks that total $1,500 or higher for as many as 10 days.

You log into your online banking account and download an image of a canceled check made out to your landlord, for the full amount of your rent. This image will prove that your landlord deposited a check that you wrote, and will show the date that the check was deposited. If you have an online account that you can use to access your bank account, there’s a good chance that you can access your canceled checks through your online banking account. Often, there is a fee for getting a copy of canceled checks. The size of the fee varies from bank to bank, but they tend to be sizable enough that it’s only worth requesting copies of canceled checks if you have a reason to need them.

A canceled check is a check that you wrote to a vendor or employee that they in turn presented to their bank for payment and has cleared your checking account. Those of us who have been around a while remember when the envelopes with your monthly bank statements were rather thick because all of those canceled checks were returned.

When a check is canceled, the person who wrote it has the money already taken out of her account. You — or another person named on the check — have received the money, so now it’s just a historical record. Canceled checks can be used to prove that a check was deposited properly, by the correct person.

Understanding Canceled Checks

Your bank may hold a deposited check if there are insufficient funds in the payer’s account or if the payer’s account is closed or blocked for some reason. Banks usually resend checks with issues to the paying institution, but this results in a longer delay for the depositor. When you open up a bank account, financial institutions always outline their policies about deposits, including hold times for check deposits. Banks place these holds on checks in order to ensure the funds are available in the payer’s account before giving you access to the cash.

Traditionally, canceled checks were returned to account holders with their monthly statements. That is now rare, and most check writers receive scanned copies of their canceled checks, while the banks create digital copies for safekeeping. They are documents or contracts between the bank and a depositor that are signed by the depositor and instruct the bank to pay another third party the depositor’s money. When you deposit money in a checking account, the bank holds the money on account for you. Writing a check simply notifies the bank to take money out of your account and give it to the recipient on the check.

If the canceled check made its way into your account, the money would be removed within days. The bank would hit you with a processing charge, and depending on the check amount and your current balance, your account could then be overdrawn. This would cause your bank to refuse payment on checks you have written, creating a snowball of negative effects on your finances. Save yourself time, money and the ability to have a checking account — don’t try to deposit a canceled check. It will cause a range of problems in your account and maybe even for you personally.

What is a canceled check?

A canceled check is a check that has been paid or cleared by the bank it was drawn on after it has been deposited or cashed. The check is “canceled” after it’s been used or paid so that the check cannot be used again.