Ageing

A business owner can verify open or outstanding liability accounts in the open reconciliation report against financial information contained in the company’s general ledger. This allows a small business owner to confirm that her company is making payments to correct vendors and that the business isn’t carrying any delinquent open liability accounts. Finding unbalances between the general ledger and the open reconciliation report can indicate simple math errors or missed vendor payments. The accounts manager uses the aging balance to measure the quality of its overall accounts receivable and per customer. All his actions are done to prevent receivables are moving to right columns in order to preserve cash and profitability of his business.

Accounts payable section is set up based on the probable number of vendors & service providers, the volume of the payments that would be processed for a period of time and the nature of reports that would be required by the management. Accounts payable and its management is a critical business process through which an entity manages its payable obligations effectively. Accounts payable is the amount owed by an entity to its vendors/suppliers for the goods and services received. To elaborate, once an entity orders goods and receives before making the payment for it, it should record a liability in its books of accounts based on the invoice amount.

A key outcome of accounts payable analysis is to alter payables processes to reduce the risk that any flaws found can recur in the future. Doing so can improve overall corporate profitability by avoiding excess expenditures. Every entity will have an accounts payable department and its structure depends upon the size of the business.

Invoices that are past due for longer periods of time have a higher default rate as a result of the higher likelihood of default. The sum of the products from each outstanding date range provides an estimate regarding the number of uncollectible receivables. The accounts payable aging report is intended to rapidly give a business owner an idea of all the payments that will be due in the immediate future. However, in order to interpret the report correctly, it’s necessary to steer clear of one potential pitfall.

Once these factors are accounted for, the optimal body weight above age 65 corresponds to a leaner body mass index of 23 to 27. Accounting software available in the market which can streamline the accounts payable process. Within accounts payable, there are many report options to choose from. All of them have a purpose, though some are more useful to business owners than others. This means striving for accurate and timely entry and payment, to ensure the reporting data is accurate as well.

This short-term liability due to the suppliers, vendors, and others is called accounts payable. Once the payment is made to the vendor for the unpaid purchases, the corresponding amount is reduced from the accounts payable balance. The voucher activity report of accounts payable details payment vouchers made over a specific time period meeting specific criteria, including spending within a given company department, particular business project or target vendor account. A business owner reviewing this information can directly trace where his money is going within the targeted report criteria.

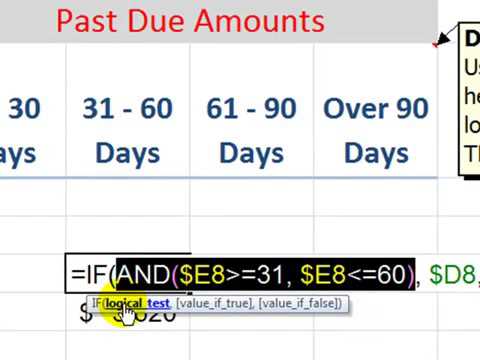

One supplier may expect you to pay within 30 days, while another requires payment within 10 days. Since the “bucket” model of the report simply groups impending payments into 30-day increments, it does not necessarily account for individual supplier due dates. Use Excel to determine which customers are paying on time, which are not, and how far they are behind the payment date. This analysis assists in estimating bad debts and in establishing credit guidelines.

Invoice Aging Reports also let you know if collection of accounts receivable are going smoothly, or faster or slower than normal. Divide total annual purchases by the average total payables balance to arrive at the payables turnover rate.

AP includes anything a business uses or buys throughout the course of conducting business, including inventory, production materials, office supplies, utilities, travel and entertainment expenses, and so on. AP reports generally cover one month or less, despite the fact that the time frame for reporting may vary depending on business owner needs and payment schedules. AP reports are also used to verify bill payments and assist with cash flow management. Older receivables can signify a weak collection process and impact your cash flow.

Page Used to Define Aging IDs

Omitting records means liabilities will be omitted from the balance sheet and income statements, but duplicating them means liabilities are overstated, as well as expenses. Accounts payable represent cash expenses because accounting considers short payment terms in business credit the same as using cash to make the payment. It doesn’t matter if payment is made with check, bank transfer, or credit card – it’s all the same to accounts payable.

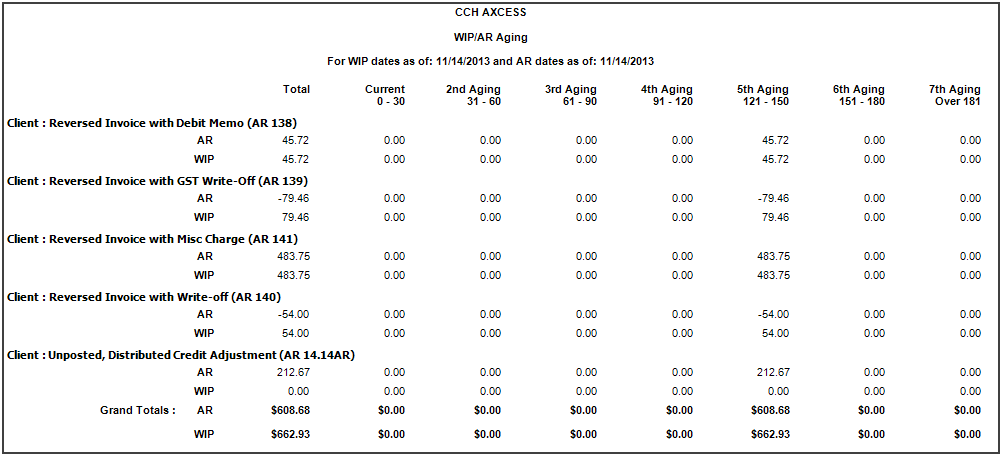

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

- In rodents, this has been shown to increase lifespan by up to 50%; similar effects occur for yeast and Drosophila.

- Caloric restriction substantially affects lifespan in many animals, including the ability to delay or prevent many age-related diseases.

- Typically, this involves caloric intake of 60–70% of what an ad libitum animal would consume, while still maintaining proper nutrient intake.

It indicates the total accounts receivable balance that have been outstanding for specified periods of time. The accounts receivable aging report is beneficial for estimating the total amount to be written off.

Typically, an AP aging report is organized into separate “buckets,” with each bucket representing a 30-day period. These buckets allow a business owner to quickly recognize the payments due in the present month, the following month, and so forth. Without an accounts receivable aging report, it can be difficult to maintain a healthy cash flow and identify potentially bad credit risks to your business. While generating the accounts receivable aging report, make sure to include the client information, status of collection, total amount outstanding and the financial history of each client. Similarly, it is sometimes claimed that moderate obesity in later life may improve survival, but newer research has identified confounding factors such as weight loss due to terminal disease.

Keep Track of Your Accounts Receivable

What is aging report in accounts payable?

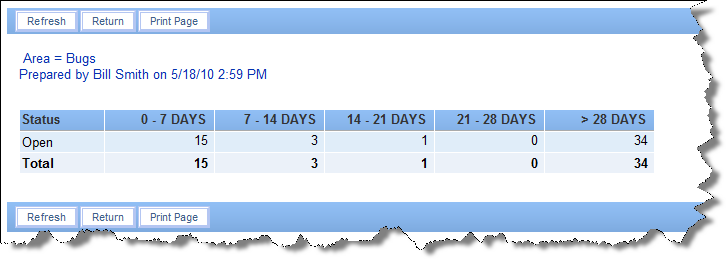

An accounts receivable aging is a report that lists unpaid customer invoices and unused credit memos by date ranges. The aging report is the primary tool used by collections personnel to determine which invoices are overdue for payment.

Conduct these same analyses whenever the company acquires another business, to see if the payables situation at the acquiree can be improved upon. If so, this can create a synergy that can save money for the acquirer. The payables manager can also discuss the results of this analysis with the purchasing manager. A possible goal to offer the purchasing manager is longer payment terms from suppliers. Doing so increases the working capital funds available to the business.

How do I prepare an AR aging report?

The Invoice Aging Report Template for Excel allows you to list down your accounts receivable and keep track of their due dates. This template also lets you determine which accounts have an outstanding balance and which are overdue or due within a given time frame.

Both studies nevertheless showed improvement in a number of health parameters. They conclude that moderate calorie restriction rather than extreme calorie restriction is sufficient to produce the observed health and longevity benefits in the studied rhesus monkeys.

Then divide the turnover rate into 365 days to determine the average number of days that the company is taking to pay its bills. If this days of payables figure is declining over time, the company is wasting a valuable source of cash. Possible resolutions are to ensure that the accounting staff does not pay invoices early, and that payment terms negotiated with suppliers are not excessively short. The aging schedule is a table that shows the relationship between the unpaid invoices and bills of a business with their respective due dates. It’s called aging schedule because the accounts receivables are broken down into age categories.

Track Accounts Receivable With Invoice Aging Report Template For Excel

For example, if a small business owner wants to double-check a project’s expenditures against its operating budget, generating a voucher activity report reveals the total expenditures for the project through company payment vouchers. A business uses payment vouchers to provide greater detail to expenditures, including the name of creditors and dates of transactions. The open reconciliation report in accounts payable shows all accounting activity relating to issued payment vouchers for debts over a given time period. The open reconciliation report refers to company debts collectively as liability accounts.

Caloric restriction substantially affects lifespan in many animals, including the ability to delay or prevent many age-related diseases. Typically, this involves caloric intake of 60–70% of what an ad libitum animal would consume, while still maintaining proper nutrient intake. In rodents, this has been shown to increase lifespan by up to 50%; similar effects occur for yeast and Drosophila. No lifespan data exist for humans on a calorie-restricted diet, but several reports support protection from age-related diseases.

The Accounts Receivable (A/R) Aging report is a critical tool for managing your business. Most factoring companies request an A/R Aging Report as part of their application package because it gives them a good idea of your receivables portfolio. Surprisingly, a number of companies do not have this valuable report available – a sure indication that they are not using it. This article helps you understand the A/R Aging Report and why factoring companies ask for it.

Accounts receivable aging reports allow you to monitor your unpaid invoices and contact late-paying customers. Keeping track and managing your accounts receivable is important in ensuring a liquid cash flow. One of the main aspects of accounts receivable management is invoice aging reporting. Creating Invoice Aging Reports allow you to determine where your accounts receivable your income are coming from and who or what are your best customers.