Acquired Equipment

The accumulated depreciation balance increases over time, adding the amount of depreciation expense recorded in the current period. Depreciation is how the costs of tangible and intangible assets are allocated over time and use. Both public and private companies use depreciation methods according to generally accepted accounting principles, or GAAP, to expense their assets. The matching principle under generally accepted accounting principles (GAAP) dictates that expenses must be matched to the same accounting period in which the related revenue is generated. Through depreciation, a business will expense a portion of a capital asset’s value over each year of its useful life.

This means that each year a capitalized asset is put to use and generates revenue, the cost associated with using up the asset is recorded. Businesses usually prefer to take tax deductions for purchases of business assets currently rather than spread them out over time. But the IRS has strict rules on what costs can be immediately expensed. As noted above, the IRS usually wants the costs of buying capital assets to be capitalized and spread out. Common types of capital assets are buildings, land, equipment, and vehicles.

Some accounting specialists also include intangible assets (like patents, trademarks, and copyrights) in the category of capital expenses. When you purchase the equipment, all entries made to account for the purchase appear on your balance sheet, not your income statement.

AccountingTools

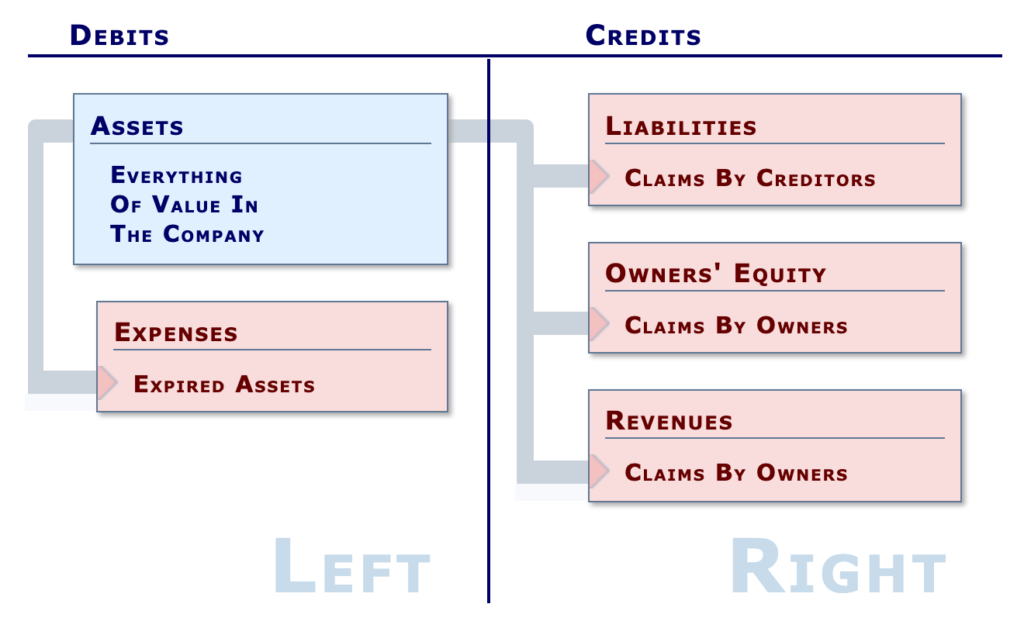

Acquisition costs are useful because they recognize a more realistic cost on a company’s financial statements than using other measures. Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset. This account is paired with the fixed assets line item on the balance sheet, so that the combined total of the two accounts reveals the remaining book value of the fixed assets.

This method is also known as reducing balance method, written down value method or declining balance method. A fixed percentage of depreciation is charged in each accounting period to the net balance of the fixed asset under this method. This net balance is nothing but the value of asset that remains after deducting accumulated depreciation.

Straight-line depreciation is calculated as (($110,000 – $10,000) / 10), or $10,000 a year. This means the company will depreciate $10,000 for the next 10 years until the book value of the asset is $10,000.

Depreciation also affects your business taxes and is included on tax statements. Accumulated depreciation is the total amount an asset has been depreciated up until a single point. Each period, the depreciation expense recorded in that period is added to the beginning accumulated depreciation balance. An asset’s carrying value on the balance sheet is the difference between its historical cost and accumulated depreciation. At the end of an asset’s useful life, its carrying value on the balance sheet will match its salvage value.

What is included in the acquisition cost of a piece of equipment?

Acquisition cost refers to the all-in cost to purchase an asset. These costs include shipping, sales taxes, and customs fees, as well as the costs of site preparation, installation, and testing. When acquiring property, acquisition costs can include surveying, closing fees, and paying off liens.

Each year the contra asset account referred to as accumulated depreciation increases by $10,000. For example, at the end of five years, the annual depreciation expense is still $10,000, but accumulated depreciation has grown to $50,000. It is credited each year as the value of the asset is written off and remains on the books, reducing the net value of the asset, until the asset is disposed of or sold.

Customer Acquisition Cost: The One Metric That Can Determine Your Company’s Fate

It is important to note that accumulated depreciation cannot be more than the asset’s historical cost even if the asset is still in use after its estimated useful life. Company A buys a piece of equipment with a useful life of 10 years for $110,000. The equipment is going to provide the company with value for the next 10 years, so the company expenses the cost of the equipment over the next 10 years.

Capital expenses are money a business spends on certain assets of the business each year both for the cost of the assets and their upkeep. These expenses are deductible business expenses, but in a different way from other business assets. “Averages” are technically median figures to account for outliers.

- This account is paired with the fixed assets line item on the balance sheet, so that the combined total of the two accounts reveals the remaining book value of the fixed assets.

- Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset.

- Acquisition costs are useful because they recognize a more realistic cost on a company’s financial statements than using other measures.

Each month, your journal entry will credit accumulated depreciation, a balance sheet account, and debit depreciation expense, an income statement account. Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery, equipment, etc into the expense. It refers to the decline in the value of fixed assets due to their usage, passage of time or obsolescence. Prior to 2009, merger and acquisition (M&A) transaction costs were capitalized and recorded as part of the purchase price of a business combination.

What Is the Tax Impact of Calculating Depreciation?

After construction is complete and the building is ready for productive use, interest payments are classified as interest expense. Costs to maintain a capital asset, like a piece of equipment, in working order and in its current condition are not considered capital costs or expenses.

Depreciation expense flows through to the income statement in the period it is recorded. Accumulated depreciation is presented on the balance sheet below the line for related capitalized assets.

The concept is best understood through an illustration of the straight-line method of depreciation. You purchase a piece of equipment for $20,000, expect it to have a useful life of 10 years, and estimate that at the end of 10 years it will be worth $2,000 as scrap. You can depreciate the cost of the equipment minus its scrap value, or $18,000. This yields an annual depreciation rate of $1,800, or a monthly depreciation rate of $150.

But the cost of repairing a piece of equipment to improve its condition adds to its value, so that’s a capital expense. To “capitalize” means to spend money on capital assets rather than expenses (continuing costs, like rent). The IRS requires costs of buying capital assets to be capitalized, and this means spreading the cost over time instead of taking it as an expense in the year the asset was bought.

Over time, the amount of accumulated depreciation will increase as more depreciation is charged against the fixed assets, resulting in an even lower remaining book value. Several methods of computing depreciation exist, and the IRS typically requires you to use the Modified Accelerated Cost Recovery System method.

The cost of buildings includes the purchase price and all closing costs associated with the acquisition of the buildings, including payments by the purchaser for back taxes owed. Remodeling an acquired building and making repairs necessary for it to be used are also considered part of the cost. If a building is constructed for the company over an extended period, interest payments to finance the structure are included in the cost of the asset only while construction takes place.

Accumulated Depreciation

It also had a significant impact on the bottom line of many company’s P&Ls. Even today, many CPAs and acquisition teams struggle with the accounting and tax treatment of acquisition costs. Below we will discuss the various types of costs and the general accounting and tax treatment. When recording depreciation in the general ledger, a company debits depreciation expense and credits accumulated depreciation.

Debit the appropriate asset account, such as plant equipment or office equipment, for the full amount of the purchase. The offsetting credit depends on how you paid for the equipment; it might be accounts payable, cash, or notes payable. If you do not already have an account for accumulated depreciation on equipment, or if you prefer to track accumulated depreciation by each item, establish a balance sheet account for this purpose. Depreciation is a way to account for changes in the value of an asset.

Thus, it means that depreciation rate is charged on the reducing balance of the asset. This asset is the one reflected in the books of accounts at the beginning of an accounting period.So, the book value of the asset is written down so as to to reduce it to its residual value.

But with the issuance of FASB 141-Revised (which became effective in late 2008 or 2009), things changed dramatically. Under the revised Generally Accepted Accounting Principles (GAAP) guidelines, direct M&A transaction costs now needed to be treated separately from the business combination and expensed as occurred. This was a big change and a big topic of conversation almost 20 years ago.