Ace the Investment Banking Interview Financial Statements Question

Cash revenues lead to an increase in the revenue and credit sales lead to a decrease in the liabilities as your customer commits to pay you after a specific period of time. Financial statements prepared by accountants are classified as either audited or unaudited.

Goods in inventory may be further separated into the amount of raw materials, work in progress, and finished goods ready for sale and shipping. Long-term assets are real estate, buildings, equipment and investments.

Short-term liabilities are bank loans, accounts payable, accrued expenses, sales tax payable and payroll taxes payable. The equity portion of the balance sheet has all the company’s investor contributions and the accumulated retained earnings. Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses. Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement.

An audited financial statement signifies that the accountant has verified virtually every transaction and account on the company’s books. Cash balances are checked by obtaining statements from the bank. Accounts receivable are confirmed by asking customers to verify the balances owed.

What is an accounting statement?

Definition. A financial statement is actually a collection of four separate accounting statements: a balance sheet, an income statement, a cash flow statement and a statement of shareholder’s, or owner’s, equity.

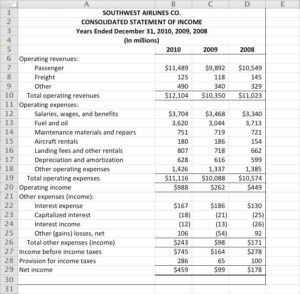

Also known as theprofit and loss statementor the statement of revenue and expense, the income statement primarily focuses on a company’s revenues and expenses during a particular period. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses.

But combined, they provide very powerful information for investors. And information is the investor’s best tool when it comes to investing wisely. The cash flow statement is different from the income statement and balance sheet because it only records cash activities from operations. It considers movements of cash such as payments of interest, taxes, wages, rents and suppliers. This statement does not include sales made on credit or the future collection of accounts receivable.

The balance sheet shows the company’s resources (assets) and funding for those resources (liabilities and stockholder’s equity). The first part of a cash flow statement analyzes a company’s cash flow from net income or losses.

Five types of Financial Statements:

Interest income is the money companies make from keeping their cash in interest-bearing savings accounts, money market funds and the like. On the other hand, interest expense is the money companies paid in interest for money they borrow. Some income statements show interest income and interest expense separately. The interest income and expense are then added or subtracted from the operating profits to arrive at operating profit before income tax. The main purpose of the income statement is to convey details of profitability and the financial results of business activities.

Revenue is what comes when the company sells their products or deliver their services. Revenue is the income of the business, thus resulting in increasing of assets and decreasing of liabilities.

For inventory, the accountants check purchase orders and receipts, and physically count the raw materials and stock on the premises. Government regulations require all publicly traded companies to prepare audited financial statements. The statements must comply with Generally Accepted Accounting Principles and be certified by independent accountants. A profit and loss statement, or income statement, sums up a company’s revenues, expenses and costs incurred over a specific period.

It shows that the company’s assets equal liabilities plus owner’s equity. Balance sheet assets are represented as either long-term, such as buildings, furniture and equipment, or short-term, such as inventory, receivables and cash in the bank. Long-term liabilities include items such as loans, while short-term liabilities include accounts payable.

Balance Sheet

- The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential.

- Assets and liabilities are separated on the balance into short- and long-term accounts.

For most companies, this section of the cash flow statement reconciles the net income (as shown on the income statement) to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities. Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income statement provides an overview of revenues, expenses, net income and earnings per share. A balance sheet is a statement of a company’s financial position at a single point in time, usually month-end or year-end.

Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories. Next companies must account for interest income and interest expense.

In this case, his bottom line is $1,200 less with no revenue to offset it, and his net profit (the amount of money the company earned, minus its expenses) for the business in 2004 is lower. This scenario may not necessarily be a bad thing if he’s trying to reduce his tax hit for 2004. The balance sheet contains assets, liabilities, and owners’ or shareholders’ equity.

Thus, the income statement, when used by itself, can be somewhat misleading. Unlike the income statement, the balance sheet does not account for the entire period and rather is a snapshot of the company at a specific point in time such as the end of the quarter or year.

It shows a company’s ability or inability to make a profit by increasing revenues or reducing costs of operations. The profit and loss statement is the one report that usually receives the most attention – after all, the goal of every business is to make a profit. If he uses the cash-basis accounting method, because no cash changes hands, the carpenter doesn’t have to report any revenues from this transaction in 2004.

Owner’s equity is the owner’s capital account showing how much he has invested in his company. The notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the company, and potential liabilities and potential losses. The notes contain information that is critical to properly understanding and analyzing a company’s financial statements.

The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. Assets and liabilities are separated on the balance into short- and long-term accounts. Short-term assets include cash on hand, accounts receivable and inventory.

However, it can be very effective in showing whether sales or revenue is increasing when compared over multiple periods. Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time. A possible candidate for most important financial statement is the statement of cash flows, because it focuses solely on changes in cash inflows and outflows. This report presents a more clear view of a company’s cash flows than the income statement, which can sometimes present skewed results, especially when accruals are mandated under the accrual basis of accounting. The most important financial statement for the majority of users is likely to be the income statement, since it reveals the ability of a business to generate a profit.

Cash Flow Statement

Also, the information listed on the income statement is mostly in relatively current dollars, and so represents a reasonable degree of accuracy. However, it does not reveal the amount of assets and liabilities required to generate a profit, and its results do not necessarily equate to the cash flows generated by the business. Also, the accuracy of this document can be suspect when the cash basis of accounting is used.

For example, if a painter completed a project on December 30, 2003, but doesn’t get paid for it until the owner inspects it on January 10, 2004, the painter reports those cash earnings on her 2004 tax report. In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. An income statement is one of the three important financial statements used for reporting a company’sfinancial performanceover a specific accounting period.