Accumulated depreciation

Why Accumulated Depreciation is a Credit Balance

Is depreciation an asset or liability?

The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated Depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets).

Over the asset’s useful life, depreciation systematically moves the asset’s costs from the balance sheet to expenses on an income statement. The simplified version of these adjustments is that a special deferred tax asset will be put on the balance sheet to serve as a way to adjust for the difference between the income statement and the cash flow statement. That deferred tax asset will be reduced over time until the reported income under GAAP and the reported income to the IRS align at the end of the straight line depreciation schedule.

However, accumulated depreciation plays a key role in reporting the value of the asset on the balance sheet. The purpose of depreciation is to match the cost of a productive asset, that has a useful life of more than a year, to the revenues earned by using the asset. The asset’s cost is usually spread over the years in which the asset is used.

Definition of Journal Entry for Depreciation

Each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation account is credited for the same amount. Over the years, accumulated depreciation increases as the depreciation expense is charged against the value of the fixed asset.

A depreciation method commonly used to calculate depreciation expense is the straight line method. Depreciation is an accounting method for allocating the cost of a tangible asset over time. Companies must be careful in choosing appropriate depreciation methodologies that will accurately represent the asset’s value and expense recognition. Depreciation is found on the income statement, balance sheet, and cash flow statement. It can thus have a big impact on a company’s financial performance overall.

The displays have a useful life of 10 years and will have no salvage value. The straight-line method of depreciation will result in depreciation of $1,000 per month ($120,000 divided by 120 months). The monthly journal entry to record the depreciation will be a debit of $1,000 to the income statement account Depreciation Expense and a credit of $1,000 to the balance sheet contra asset account Accumulated Depreciation. Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed assets like property, plant, and equipment are long-term assets.

Depreciation expenses a portion of the cost of the asset in the year it was purchased and each year for the rest of the asset’s useful life. Accumulated depreciation allows investors and analysts to see how much of a fixed asset’s cost has been depreciated.

It is accounted for when companies record the loss in value of their fixed assets through depreciation. Physical assets, such as machines, equipment, or vehicles, degrade over time and reduce in value incrementally. Unlike other expenses, depreciation expenses are listed on income statements as a “non-cash” charge, indicating that no money was transferred when expenses were incurred. Let’s assume that a retailer purchased displays for its store at a cost of $120,000.

Depreciation is a way to account for changes in the value of an asset. Depreciation also affects your business taxes and is included on tax statements.

- Depreciation is defined as the expensing of an asset involved in producing revenues throughout its useful life.

- Depreciation expense affects the values of businesses and entities because the accumulated depreciation disclosed for each asset will reduce its book value on the balance sheet.

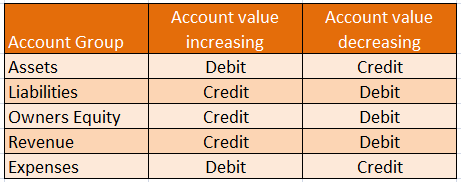

Why is Accumulated Depreciation a Credit Balance?

The most basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement, and the other is a contra asset reported on the balance sheet. The purpose of the journal entry for depreciation is to achieve the matching principle. In each accounting period, part of the cost of certain assets (equipment, building, vehicle, etc.) will be moved from the balance sheet to depreciation expense on the income statement. The goal is to match the cost of the asset to the revenues in the accounting periods in which the asset is being used.

Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. The use of a depreciation method allows a company to expense the cost of an asset over time while also reducing the carrying value of the asset. Initially, most fixed assets are purchased with credit which also allows for payment over time. The initial accounting entries for the first payment of the asset are thus a credit to accounts payable and a debit to the fixed asset account.

An example of how to calculate depreciation expense under the straight-line method — assume a purchased truck is valued at USD 10,000, has a residual value of USD 5,000, and a useful life of 5 years. Its depreciation expense for year 1 is USD 1,000 (10,000 – 5,000 / 5). The journal entry for this transaction is a debit to Depreciation Expense for USD 1,000 and a credit to Accumulated Depreciation for USD 1,000. On the balance sheet, a company uses cash to pay for an asset, which initially results in asset transfer.

The carrying value would be $200 on the balance sheet at the end of three years. The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet. For example, if a company buys a vehicle for $30,000 and plans to use it for the next five years, the depreciation expense would be divided over five years at $6,000 per year. Each year, depreciation expense is debited for $6,000 and the fixed asset accumulation account is credited for $6,000.

The accounting entries for depreciation are a debit to depreciation expense and a credit to fixed asset depreciation accumulation. Each recording of depreciation expense increases the depreciation cost balance and decreases the value of the asset. Accumulated depreciation is applicable to assets that are capitalized.

Is depreciation a liability? Why or why not?

After five years, the expense of the vehicle has been fully accounted for and the vehicle is worth $0 on the books. Depreciation helps companies avoid taking a huge expense deduction on the income statement in the year the asset is purchased. Depreciation spreads the expense of a fixed asset over the years of the estimated useful life of the asset.

Because a fixed asset does not hold its value over time (like cash does), it needs the carrying value to be gradually reduced. Depreciation expense gradually writes down the value of a fixed asset so that asset values are appropriately represented on the balance sheet.

When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation account. Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero. The depreciation method chosen should be appropriate to the asset type, its expected business use, its estimated useful life, and the asset’s residual value. The amount reduces both the asset’s value and the accounting period’s income.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Depreciation is defined as the expensing of an asset involved in producing revenues throughout its useful life. Depreciation for accounting purposes refers the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching of revenues to expenses principle). Depreciation expense affects the values of businesses and entities because the accumulated depreciation disclosed for each asset will reduce its book value on the balance sheet. Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. Such expense is recognized by businesses for financial reporting and tax purposes.