Accrued expenses

How to Adjust Journal Entry for Unpaid Salaries

The most common method of accounting used by businesses is accrual-basis accounting. Two important parts of this method of accounting are accrued expenses and accrued revenues. Accrued expenses are expenses that are incurred in one accounting period but won’t be paid until another. Primary examples of accrued expenses are salaries payable and interest payable.

What is the adjusting entry for accrued salaries?

Accrued salaries refers to the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them. This information is used to determine the residual compensation liability of a business as of a specific point in time.

The term accrue, when related to finance, is synonymous with an “accrual” under the accounting method outlined by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). An accrual is an accounting adjustment used to track and record revenues that have been earned but not received, or expenses that have been incurred but not paid. Think of accrued entries as the opposite of unearned entries; the corresponding financial event has already taken place but payment has not yet been made or received. There are a few common types of accrued expenses and accrued revenues. Falling under the accrued expenses category are salaries payable and interest payable.

Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid. This isn’t the only method of accounting, and most certainly not the one most businesses use. Instead, they use the accrual method of accounting, where revenue is recorded when it is earned, regardless of when it is received, and expenses are recorded when they are incurred, regardless of when they are paid. If companies withhold any payroll taxes on behalf of employees, the cash payments are reduced by the amount of taxes to arrive at the net pay for employees.

Accrued Expense vs. Accrued Interest: What’s the Difference?

Accrued revenue is the product of accrual accounting and the revenue recognition and matching principles. The revenue recognition principle requires that revenue transactions be recorded in the same accounting period in which they are earned, rather than when the cash payment for the product or service is received.

Therefore, the longer the time difference between when companies accrue their payroll and when they actually make payroll payments, the more the companies’ labor expenses are financed by their employees. When accrued revenue is first recorded, the amount is recognized on theincome statementthrough a credit to revenue. An associated accrued revenue account on the company’s balance sheet is debited by the same amount, potentially in the form ofaccounts receivable. When a customer makes payment, an accountant for the company would record an adjustment to the asset account for accrued revenue, only affecting the balance sheet.

The matching principle is an accounting concept that seeks to tie revenue generated in an accounting period to the expenses incurred to generate that revenue. Under generally accepted accounting principles (GAAP), accrued revenue is recognized when the performing party satisfies a performance obligation. For example, revenue is recognized when a sales transaction is made and the customer takes possession of a good, regardless of whether the customer paid cash or credit at that time. Contrary to Cash Basis Accounting, in Accrual Basis Accounting, financial items are accounted when they are earned and deductions are claimed when expenses are incurred, irrespective of the actual cash flow. Accrual accounting method measures the financial performance of a company by recognizing accounting events regardless of when corresponding cash transactions occur.

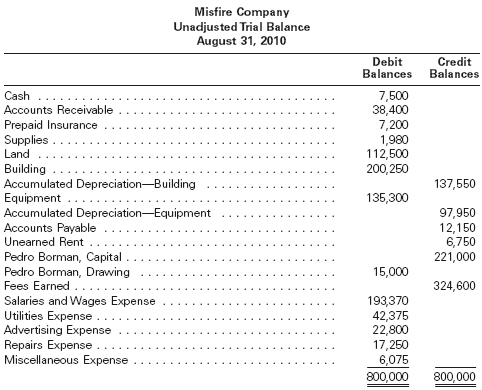

A company pays its employees’ salaries on the first day of the following month for services received in the prior month. So, employees that worked all of November will be paid in December. If on December 31, the company’s income statement recognizes only the salary payments that have been made, the accrued expenses from the employees’ services for December will be omitted.

- Two important parts of this method of accounting are accrued expenses and accrued revenues.

- The most common method of accounting used by businesses is accrual-basis accounting.

- Accrued expenses are expenses that are incurred in one accounting period but won’t be paid until another.

In a cash-based accounting approach, a company records only the transactions where cash changes hands. Accruals form the base for accrual accounting and incorporate all transactions, including accounts receivable, accounts payable, employee salaries, etc.

What Is an Accrued Expense?

If a company incurs an expense in one period but will not pay the expense until the following period, the expense is recorded as a liability on the company’s balance sheet in the form of an accrued expense. When the expense is paid, it reduces the accrued expense account on the balance sheet and also reduces the cash account on the balance sheet by the same amount. The expense is already reflected in the income statement in the period in which it was incurred. Accrued revenues are revenues earned in one accounting period but not received until another. The most common forms of accrued revenues recorded on financial statements are interest revenue and accounts receivable.

Salaries payable are wages earned by employees in one accounting period but not paid until another accounting period. Interest payable is interest expense that has accumulated but not yet been paid. This is in contrast to the cash method of accounting where revenues and expenses are recorded when the funds are actually paid or received, leaving out revenue based on credit and future liabilities. The use of accruals allows a business to look beyond simple cash flow.

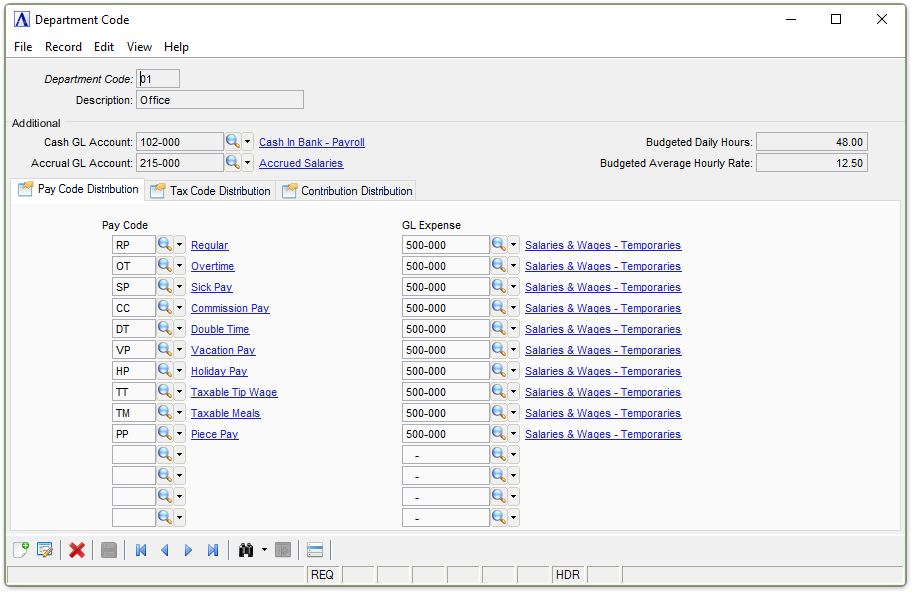

Accrued payroll may be paid immediately at the period end or later, on the next payday. Companies use different journal entries to record accrued payroll, payroll payable and payroll cash payments.

Accrual Accounting vs. Cash Basis Accounting

Accrual follows the matching principle in which the revenues are matched (or offset) to expenses in the accounting period in which the transaction occurs rather than when payment is made (or received). Accrued revenues are revenues that are earned in one accounting period, but cash is not received until another accounting period. Accrued expenses are expenses that have been incurred in one accounting period but won’t be paid until another accounting period. When something financial accrues, it essentially builds up to be paid or received in a future period.

Salaries payable are wages earned by employees in one accounting period but not paid until the next, while interest payable is interest expense that has been incurred but not yet paid. Accruals are revenues earned or expenses incurred which impact a company’s net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities. Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable. Under the expense recognition principles of accrual accounting, expenses are recorded in the period in which they were incurred and not paid.

Recording an amount as an accrual provides a company with a more comprehensive look at its financial situation. It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. Accrued incomes are revenues that are earned in one accounting period, but cash is not received until another accounting period. A credit to the account of payroll payable increases the amount of payroll liability for the company.

Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven’t been paid for yet. Accrued revenues and accrued expenses are both integral to financial statement reporting because they help give the most accurate financial picture of a business.

Make the Adjusting Journal Entries

Companies then use another credit entry of payroll tax payable to offset the difference between the amount of total payroll and the amount of net pay. Accrued payroll is another term for accrued wages and salaries, which are labor costs that companies incur over time. Because companies pay employees wages and salaries periodically, daily journal entry of payroll expense is not necessary and companies need only to accrue payroll at the end of each accounting period.