Accounts payable procedures: Accounts Payable Process

The accounts payable process has traditionally been viewed mainly in utilitarian terms. AP existed to serve the business’s supply-based needs and to meet its obligations to, and as created, by other departments and processes within the company. Although this remains its core function, it should be clear that this function can generate value for the business in and of itself. With Kofax software solutions, businesses can transform the full cycle of their AP process while unlocking new opportunities simultaneously. With best-in-class accounts payable automation and AI-powered invoice automation, it’s easy to transform the entire cycle from upstream efforts to the day-to-day downstream work. Reliable accounting practices are an essential element not only to long-term success but to meeting short-term goals, too.

- For analyzing expense reports, financial statements, and the general ledger, a spreadsheet works well for a small AP office.

- AR is the money a company expects to receive from customers and AP is the money a company owes to its vendors.

- The best AP professionals are skilled in both managing numbers and managing a number of human relationships, both inside and outside your organization.

For example, if you’re wondering how much you’ve spent on utilities for the year, just access the Utilities Expense account to view the total. Once this is complete, you can begin the process of entering the invoice information, either in your ledger accounts or in your software application. If you typically enter all accounts payable for your business, you can approve bills as you review them. On the other hand, accounts receivable (A/R) is money owed to you for goods or services you provided to your customers on credit.

Best Practices For an Accounts Payable Process

These invoices are generally outstanding amounts for particular goods or services purchased. For example, a company does not issue a purchase order to its electric utility for a pre-established amount of electricity for the following month. The same is true for the telephone, natural gas, sewer and water, freight-in, and so on. The difference between them is that accounts payable is short-term debts your business owes to suppliers. Accounts receivable deals with monies the business expects to receive from customers or partners on credit.

Management often chooses to make purchases that cannot be immediately paid for since the expected return on investment is too great to pass up at the moment. Accounts payable prevents overspending and makes sure that repayment is both possible and able to be done in a timely fashion. If a bill is for products ordered, be sure to verify that the products listed on the invoice have all been received.

Streamlining the accounts payable process & AP cycle

In fact, AP is arguably the most vital task to optimize in today’s competitive market. The accounts payable department performs a critical business process that’s expectedly multifaceted and complex to understand. The exact responsibilities of AP differs depending on the size and type of the business. Some larger companies have dedicated departments while others combine the work alongside accounts receivable. When you use accounting software, you or your clerk can code the invoice to the proper expense account.

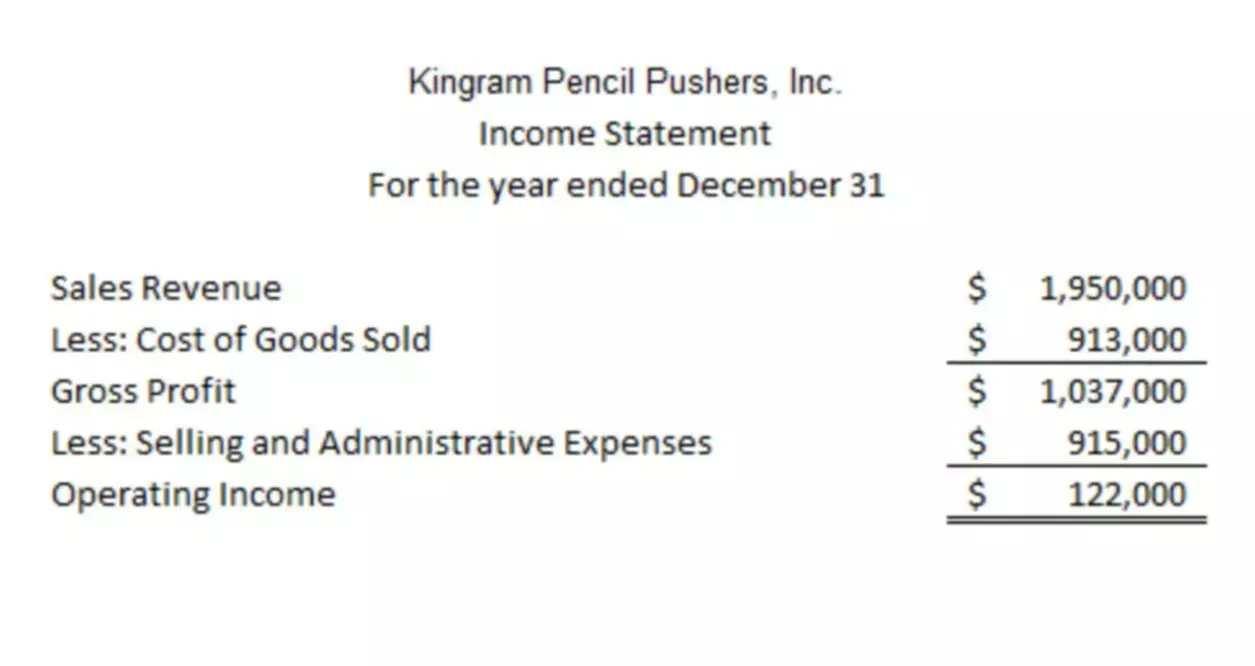

Accounts payable is shown on a businesses balance sheet, while expenses are shown on an income statement. Organizations, in turn, gain more control over outgoing cash and can even transform AP from a cost center to a profit center. After the receiving report and purchase order information are reconciled, they need to be compared to the vendor invoice. Hence, the receiving report is the second of the three documents in the three-way match (which will be discussed shortly). The quantity and description of the goods shown on the receiving report should be compared to the information on the company’s purchase order.

What are the challenges faced by accounts payable?

Having sufficient operating procedures is extremely important to reduce improper payments, ensure regulatory compliance, and reduce the risk of human error. AP and AR exist because the moment you choose to purchase products rarely happens at the same time as the moment you set down the money and receive the goods. Because spending and receiving money happens on a schedule, ensuring that you are never stuck without enough to make a payment requires AP and AR to work together and coordinate budgeting. The AP department works with its own set of metrics to analyze the liquidity of a business.

Accounts payable works whenever the organization orders from suppliers or service providers; it handles all the money owed by the company. Accounts receivable goes the other way; it covers the products and services your own business sells to customers on credit. Do not confuse accounts payable with a related but separate department known as accounts receivable (AR). They are both vital components of the accounting process but fulfill entirely different roles. A dedicated AP team largely deals with short-term debts like car leasing agencies and freelance work that gets paid off within a year.

Capturing Data and Making Payments

This method allows you to view incoming bills and help to ensure accuracy while avoiding payment errors. Accounts payable is a liability account, so if you’re using double-entry accounting, any increase to this account would be posted as a credit, with a corresponding debit made to an expense account. If you’re a very small business, it’s likely you can pay your bills as soon as you get them. However, if you have multiple bills to pay, you’ll likely add them to accounts payable to be paid at a later date.

With so much data passing through so many hands, there are many opportunities for mistakes. Businesses worldwide base their operations on the expenditure cycle and the revenue cycle. The accounts payable process falls under the broader expenditure and purchasing cycle. AR is the money a company expects to receive from customers and AP is the money a company owes to its vendors.

To tackle the issues that prevent AP teams from being efficient, there are a set of best practices that help streamline the accounts payable process from start to end. With robust ERP connectors, you can de-silo accounts payable and include the full scope of its data in the systems your business uses to make every important decision. The above describes an overall view of the accounts payable workflow, but what about more of the detailed operations that take place on a daily basis? Here’s a quick overview of some of the responsibilities overseen by those handling the AP process. The AP process is just one part of the entire procure to pay (P2P) process that covers all stages of activity from purchase requisition to procurement & vendor payments.

For analyzing expense reports, financial statements, and the general ledger, a spreadsheet works well for a small AP office. No matter the size of a business, success is generally measured by the difference between the expenditure and revenue cycle. When it comes to expenditure and purchasing, having an efficient accounts payable process is vital to tracking performance.

What is the AP workflow process?

One copy of the purchase order will be used in the three-way match, which we will discuss later. AP teams must constantly be vigilant against fraud and theft, both from within the company and without. Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Learn how to overcome AP issues by optimizing your purchasing process for today’s business reality.