Accounting

Unearned revenue is money received or paid to a company for a product or service that has yet to be delivered or provided. Unearned revenue is listed as a current liability because it’s a type of debt owed to the customer. Once the service or product has been provided, the unearned revenue gets recorded as revenue on the income statement. Typically, vendors provide terms of 15, 30, or 45 days for a customer to pay, meaning the buyer receives the supplies but can pay them at a later date. These invoices are recorded in accounts payable and act as a short-term loan from a vendor.

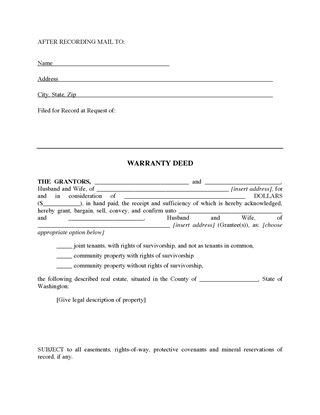

Influencers of Warranty Accrual

Is a warranty an asset?

Warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of goods that it has sold. Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account.

Each month during the coverage period, the company would recognize extended warranty revenues in the amount of 1/24th of $4,800 or $200. Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet.

Warranty Obligations Considerations

If a cost is capitalized, it is charged to expense over time through the use of amortization (for intangible assets) or depreciation (for tangible assets). A short-term variation on the capitalization concept is to record an expenditure in the prepaid expenses account, which converts the expenditure into an asset. The asset is later charged to expense when it is used, usually within a few months. A capital expenditure is a purchase that a company records as an asset, such as property, plant or equipment.

Assume that Company ABC from the example earlier also sells extended warranties on gadgets XYZ. Extended warranties go into effect after standard warranties expire (on the first anniversary of the gadget sale date) and cover the products for additional two years. In our example, for the gadgets sold in May 20X3, extended warranties sold by the company amounted to $4,800. The coverage period for the extended warranties is May 20X4 to April 20X5. We will assume that there were no contract acquisition costs and that costs related to services under extended warranties are evenly distributed over the coverage period.

If the future costs of the warranty coverage are probable and can be estimated, they are recorded at the time of the sale. The accounting entry will debit Warranty Expense and will credit Warranty Liability.

The life of these purchases extends beyond the current accounting period in which they were purchased. Because these costs can be recovered only over time through depreciation, companies usually prepare a capital expense budget apart from OPEX. A capitalized cost is recognized as part of a fixed asset, rather than being charged to expense in the period incurred. Capitalization is used when an item is expected to be consumed over a long period of time.

Generally Accepted Accounting Principles, or GAAP, provide companies guidance on how to record the initial purchase and subsequent asset expenses. The accrual should take place in the same reporting period in which the related product sales are recorded. By doing so, the financial statements most accurately represent all costs associated with product sales, and therefore indicate the true profitability associated with those sales. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

For example, you could argue that a $50 printer could be an asset or an expense. To simplify the decision, GAAP states that purchases must have an expected useful life of more than one year to be considered capital expenditures. Accrued expenses are listed in the current liabilities section of the balance sheet because they represent short-term financial obligations.

- Assume that Company ABC from the example earlier also sells extended warranties on gadgets XYZ.

Operating expenses represent the day-to-day expenses necessary to run a business. Because these are short-term costs that are used up in the same accounting period in which they were purchased, it makes sense for them to have a separate budget. In financial accounting capital expenditures (CapEx) and operating expenditures (expenses) (OPEX) are two categories of business expenses. However, there are distinct differences between the two, including their respective tax treatments. In the current period, it sold $500,000 of blue widgets, so it records a debit of $500 to the warranty expense account and $500 to the warranty liability account.

Companies typically will use their short-term assets or current assets such as cash to pay them. Current liabilities of a company consist of short-term financial obligations that are due typically within one year. Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales. Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company. Funds that fall under capital expenditures are for major purchases that will be used in the future.

Early in the following month, it receives a warranty claim to replace a blue widget. The cost of this claim is $40, which ABC records as a debit to the warranty liability account (thereby reducing the account balance) and a credit to the inventory account (to reduce the reduction of widget inventory).

Warranty expense

Instead of recognizing the expense for an asset all at once, companies can spread the expense recognition over the life of the asset. Assets generally look better on a financial statement compared to expenses, so many companies try to capitalize as many related expenses as they can.

Company

By allowing a company time to pay off an invoice, the company can generate revenue from the sale of the supplies and manage its cash needs more effectively. Accounting for warranties requires estimation and experience because not all products break.

How is warranty expense calculated?

Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account. As actual warranty claims are received, debit the warranty liability account and credit the inventory account for the cost of the replacement parts and products sent to customers.

Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon. The Financial Accounting Standards Board, which sets the standards for GAAP, states that assets deliver a probable future benefit. On the other hand, expenses result in “using up” assets, such as cash, to produce goods and services. When a company makes a purchase, it can be difficult to determine if it is an asset or if it is an expense.

Retailers don’t have to fix or replace 100% of the products they sell warranties for. If they did, they might stop selling warranties because it would be too costly. When a retailer sells a product with a warranty to a customer, the retailer records the income from the sale and the cash received.