Accounting for Investments: Cost or Equity Method

Example of the Equity Method

Since intercompany investments typically involve owning stock, you’d list the value of the investment as the price you paid for the shares. Once the investment is on the balance sheet, however, the cost and equity methods diverge substantially.

The equity method does not combine the accounts in the statement, but it accounts for the investment as an asset and accounts for income received from the subsidiary. Under the equity method, the investment is initially recorded in the same way as the cost method. However, the amount is subsequently adjusted to account for your share of the company’s profits and losses. Rather, they are considered a return of investment, and reduce the listed value of your shares. If the investee declares dividends, the investor records a journal entry for their share of the investment.

Suppose a business (the investor) buys 25% of the common stock of another business (the investee) for 220,000 in cash. The investor is deemed to exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting.

Understanding the Income Statement

Treat any dividends as a return of capital — do not book them as income but rather subtract them from the carrying value of the investment. However, under the fair value option to the equity method, you recognize as income changes to the stocks’ fair value rather than your share of investee income. Consolidating the financial statements involves combining the firms’ income statements and balance sheets together to form one statement.

If your company invests in another firm, whether it’s to form a business alliance or just to make a profit, that investment must be accounted for on your balance sheet. The cost method and the equity method apply when your ownership interest in the other company is less than a controlling stake. When the investee company pays a cash dividend, the value of its net assets decreases. Using the equity method, the investor company receiving the dividend records an increase to its cash balance but, meanwhile, reports a decrease in the carrying value of its investment.

Accounting for Intercorporate Investments: What You Need to Know

ABC records a journal entry debiting Dividends Receivable for USD 50,000 and crediting Dividend Income for USD 50,000. The Dividend Receivable is reported on the balance sheet under current assets and Dividend Income is reported on the income statement under a section for other income. By using the equity method the investor has already reflected its share of income in its income statement in the previous journal. When the dividend is paid the value of the investee business decreases and the investor reflects its share of the decrease in the investment account.

What is the equity method of accounting example?

Equity method in accounting is the process of treating investments in associate companies. The investor’s proportional share of the associate company’s net income increases the investment (and a net loss decreases the investment), and proportional payments of dividends decrease it.

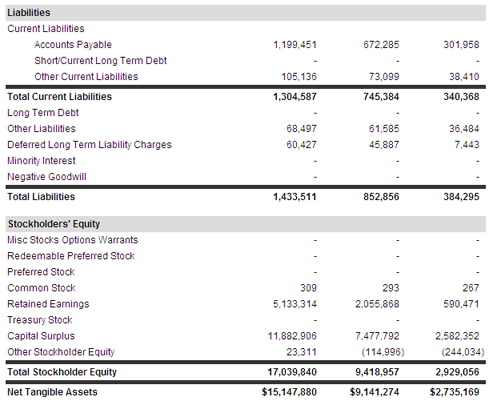

A company’s balance sheet, also known as a “statement of financial position,” reveals the firm’s assets, liabilities and owners’ equity (net worth). The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company’s financial statements. If you are a shareholder of a company or a potential investor, it is important that you understand how the balance sheet is structured, how to analyze it and how to read it. The accounting for passive investments depends on what your company plans to do with the stock it owns in the other business. If you plan to hold on to that stock indefinitely, then your company must use the cost method.

- A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations.

- It is a snapshot at a single point in time of the company’s accounts – covering its assets, liabilities and shareholders’ equity.

Under the cost method, the investment stays on the balance sheet at its original cost. If you receive any dividends from the investment, those dividends get treated as revenue. Under both the cost method and the equity method, you place your investment in the other company on your balance sheet as an asset equal in value to whatever you paid to acquire the investment.

What is equity method vs cost method?

The investor records its share of the investee’s earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

Equity Method

An example of how to determine fair value can involve the purchase of company shares of less than 20% total equity — assume ABC Corporation purchases 10% of XYZ’s Corporation’s common stock, or 50,000 shares. When the acquired company pays you a dividend, the equity method considers this a return of your investment rather than income. The dividend reduces your investment’s value but has no effect on your profit. In a journal entry, debit your cash account by the amount you receive and credit the investment account by the same amount. For example, if the acquired company pays your small business an $8,000 dividend, debit $8,000 to cash and credit $8,000 to your investment account.

Equity accounting is usually applied where an investor entity holds 20–50% of the voting stock of the associate company, and therefore has significant influence on the latter’s management. The investor’s proportional share of the associate company’s net income increases the investment (and a net loss decreases the investment), and proportional payments of dividends decrease it. In the investor’s income statement, the proportional share of the investor’s net income or net loss is reported as a single-line item.

Shareholders’ equity is the initial amount of money invested in a business. In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders’ equity on the other side. Using the equity method, a company reports the carrying value of its investment independent of any fair value change in the market.

The following is an example of how to report investments of less than 20% of shares — assume ABC Corporation purchases 10% of XYZ’s Corporation’s common stock, or 50,000 shares. When purchasing less than 20% of a company’s stock, the cost method is used to account for the investment. ABC records a journal entry for the purchase by debiting Investment in XYZ Corp. for USD 50,000 and crediting Cash for USD 50,000. The investment in XYZ Corporation is reported at cost in the asset section of the balance sheet.

The equity method is an accounting treatment used in recording equity investments to appropriately account for an investor company’s investment revenue and dividend. The use of the equity method depends on the investor company’s percentage equity holdings in the investee and its influence over the investee’s business. The equity method of treating investment revenue and dividends often results in deferred taxes, because of the discrepancy with taxable income calculated based on the tax codes. If you own between 20 percent and 50 percent of the investee’s voting shares, you automatically qualify for equity method accounting. Under this method, you book your portion of the investee’s income or losses on your income statement and update the asset’s book value accordingly.

Other financial activities that affect the value of the investee’s net assets should have the same impact on the value of the investor’s share of investment. The equity method ensures proper reporting on the business situations for the investor and the investee, given the substantive economic relationship they have. When the investor has a significant influence over the operating and financial results of the investee, it can directly affect the value of the investor’s investment. The investor records its initial investment in the second company’s stock as an asset at historical cost. Under the equity method, the investment’s value is periodically adjusted to reflect the changes in value due to the investor’s share in the company’s income or losses.

When companies acquire a minority stake in another company, there are two main accounting methods they can use.

A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations. It is a snapshot at a single point in time of the company’s accounts – covering its assets, liabilities and shareholders’ equity. The purpose of a balance sheet is to give interested parties an idea of the company’s financial position, in addition to displaying what the company owns and owes. It is important that all investors know how to use, analyze and read a balance sheet. Equity method in accounting is the process of treating investments in associate companies.