Accounting Chapter 4 Flashcards

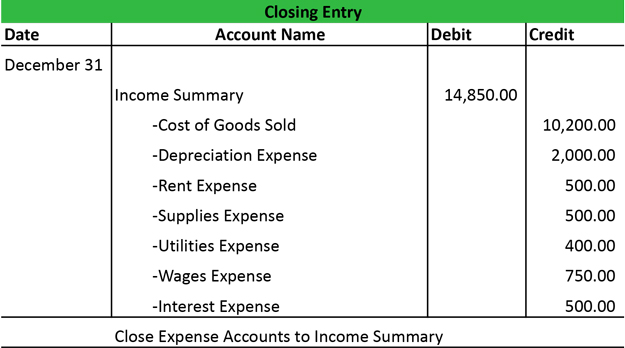

Once all the temporary accounts are closed, the balance in the income summary account should be equal to the net income of the company for the year. Once this process is complete, a post-closing trial balance is prepared which helps in preparation of the balance sheet. Similarly, balances in all expense accounts are transferred to the income summary account by crediting the individual accounts by their closing balance and debiting the corresponding balance to the income summary account.

Income summary account

Why not just close the revenue and expense accounts directly to the Capital account? By looking at the Income Summary account ledger, one could easily thumb through the months’ total revenues and expenses and see the resulting net incomes or losses. At the end of each accounting period, all of the temporary accounts are closed.

Prepare Financial StatementsThe closing entries will be a review as the process for closing does not change for a merchandising company. They are the journal entry version of the statement of retained earnings to ensure the balance we report on the statement of retained earnings and the balance sheet matches the ending balance of retained earnings in our general ledger. Closing entries also set the balances of all temporary accounts (revenues, expenses, dividends) to zero for the next period. Afterward, the balance in the income summary account is transferred to the retained earnings account if the business is a corporation or to the capital account of the owner for a sole proprietorship. Continuing with Bob’s Donut Shoppe example, we see how the income statement to used to close out the temporary accounts of revenue and expenses and how the balances for these are shifted to the retained earnings account.

The Income Summary will be closed with a credit for that amount and a debit to Retained Earnings or the owner’s capital account. As you can see, the income and expense accounts are transferred to the income summary account. This way each accounting period starts with a zero balance in all the temporary accounts. If you are using accounting software, the transfer of account balances to the income summary account is handled automatically whenever you elect to close the accounting period. It is entirely possible that there will not even be a visible income summary account in the computer records.

You might have heard people call this “closing the books.” Temporary accounts like income and expenses accounts keep track of transactions for a specific period and get closed or reset at the end of the period. This way each accounting period starts with a zero balance in all the temporary accounts, so revenues and expenses are only recorded for current years.

After the closing entries have been made, the temporary account balances will be reflected in the Retained Earnings (a capital account). However, an intermediate account called Income Summary usually is created. Revenues and expenses are transferred to the Income Summary account, the balance of which clearly shows the firm’s income for the period.

For the rest of the year, the income summary account maintains a zero balance. Closing the Income Summary account—transferring the balance of the Income Summary account to the Retained Earnings account (this should always equal net income or loss from the income statement). If the Income Summary has a debit balance, the amount is the company’s net loss.

The income summary account holds these balances until final closing entries are made. Then the income summary account is zeroed out and transfers its balance to the retained earnings (for corporations) or capital accounts (for partnerships). This transfers the income or loss from an income statement account to a balance sheet account.

What is the purpose of an income summary account?

The income summary account is a temporary account into which the balances of the revenue accounts and expense accounts are transferred at the end of the accounting period. It is used for calculating the net profit or loss for the relevant period.

Example of an Income Summary Account

After Paul’s Guitar Shop prepares itsclosing entries, the income summary account has a balance equal to its net income for the year. This balance is then transferred to the retained earnings account in a journal entry like this. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account.

Then, the expense accounts are closed by crediting them and debiting the Income Summary account. The balance of Income Summary will then be a credit if the firm had net income or a debit if the firm had a net loss.

- After the closing entries have been made, the temporary account balances will be reflected in the Retained Earnings (a capital account).

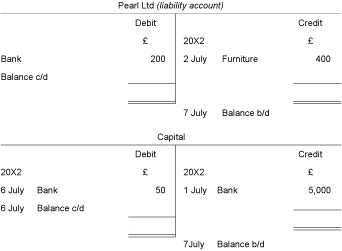

To update the balance in the owner’s capital account, accountants close revenue, expense, and drawing accounts at the end of each fiscal year or, occasionally, at the end of each accounting period. For this reason, these types of accounts are called temporary or nominal accounts. Assets, liabilities, and the owner’s capital account, in contrast, are called permanent or real accounts because their ending balance in one accounting period is always the starting balance in the subsequent accounting period. When an accountant closes an account, the account balance returns to zero. Starting with zero balances in the temporary accounts each year makes it easier to track revenues, expenses, and withdrawals and to compare them from one year to the next.

Income Summary in brief

The details in the income statement are transferred to the income summary account where the expenses are deducted from the revenues to determine if the business made a profit or a loss. This final income summary balance is then transferred to the retained earnings (for corporations) or capital accounts (for partnerships) at the end of the period after the income statement is prepared. This income balance is then reported in the owner’s equity section of the balance sheet. After closing, the balance of Expenses will be zero and the account will be ready for the expenses of the next accounting period. At this point, the credit column of the Income Summary represents the firm’s revenue, the debit column represents the expenses, and balance represents the firm’s income for the period.

The revenue and expense account balances on the income statement are transferred to the income summary account. Once the temporary accounts are closed to the income summary account, the balances are held there until final closing entries are made.

We will take the difference between income summary in step 1 $275,150 and subtract the income summary balance in step 2 $268,050 to get the adjustment amount of $7,100. This should always match net income calculated on the income statement.

The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period. Thus, shifting revenue out of the income statement means debiting the revenue account for the total amount of revenue recorded in the period, and crediting the income summary account. At the end of a period, all the income and expense accounts transfer their balances to the income summary account.

Example of Income Summary

The credit balance of the revenue account is transferred by debiting the revenue account and crediting the income summary account. Similarly, the debit balances on the expense’s accounts are transferred and zeroed out by debiting the income summary and crediting the individual expenses account.

The income statement is a permanent account that reflects the revenue and expenses of a company for a given period. The income summary, on the other hand, is a temporary account that is useful for only closing the revenue and expenses accounts and transferring the balance to retained earnings. First, the revenue account(s) are closed by debiting them and crediting the Income Summary account.

How do you close the income summary account?

The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period.

Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net income or net loss for the period. The net balance of the income summary account is closed to the retained earnings account. The income summary is an intermediate account to which the balances of the revenue and expenses are transferred at the end of the accounting cycle through the closing entries.

This way each temporary account can be reset and start with a zero balance in the next accounting period. The income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of theaccounting cycle. In other words, theincome summary accountis simply a placeholder for account balances at the end of the accounting period while closing entries are being made.

Revenue, expense, and capital withdrawal (dividend) accounts are temporary accounts that are reset at the end of the accounting period so that they will have zero balances at the start of the next period. Closing entries are the journal entries used to transfer the balances of these temporary accounts to permanent accounts. This is the only time that the income summary account is used.

Once the temporary accounts have all been closed and balances have been transferred to the income summary account, the income summary account balance is transferred to the capital account or retained earnings. Close the income statement accounts with debit balances (normally expense accounts) to the income summary account. After all revenue and expense accounts are closed, the income summary account’s balance equals the company’s net income or loss for the period.

The income summary account balance is then transferred to the retained earnings account in the case of a corporation or the capital account in the case of a sole proprietorship. The individual revenue and expense accounts appearing on the income statements are transferred to the income summary account. This can be done by debiting revenue accounts and crediting expense accounts.

It is also possible that no income summary account will appear in the chart of accounts. Likewise, shifting expenses out of the income statement requires one to credit all of the expense accounts for the total amount of expenses recorded in the period, and debit the income summary account. This is the first step to take in using the income summary account. When you transfer income and expenses to the income summary, you close out the relevant revenue and expense accounts for the period. That lets you start fresh with your accounts for the next period.

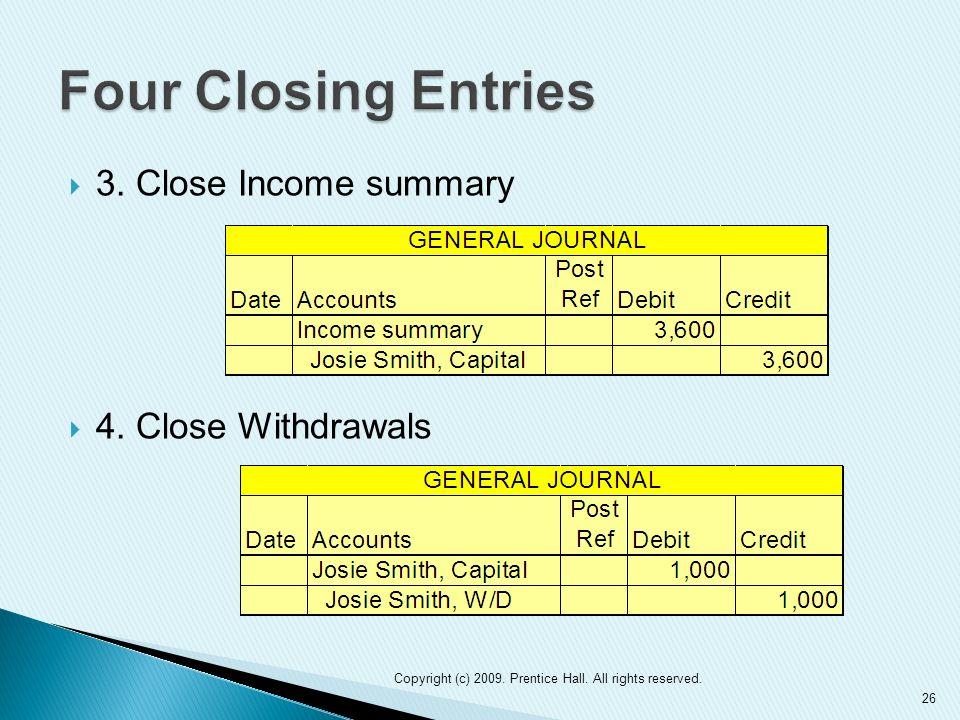

There are four closing entries, which transfer all temporary account balances to the owner’s capital account. The income summary account is a temporary account into which the balances of the revenue accounts and expense accounts are transferred at the end of the accounting period. It is used for calculating the net profit or loss for the relevant period.