Absorption dictionary definition

One of the limitations of variable costing is that it becomes very difficult and cumbersome to apply in cases where there are large stocks of work-in-progress. Absorption costing also provides a company with a more accurate picture of profitability than variable costing if all of its products aren’t sold during the same accounting period when they are manufactured. This can be especially important for a company that ramps up production well in advance of an anticipated seasonal increase in sales. Absorption costing, also known as full absorption costing, can be defined as a managerial accounting cost method of expensing all costs related to manufacturing of a specific product. The absorption costing method involves the use of total direct costs and overhead costs related to the manufacturing of a product as the cost base.

Under an absorption cost method, management can push forward costs to the next period when products are sold. This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Variable costing is generally not used for external reporting purposes. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP.

Under the variable costing method, fixed manufacturing overhead costs are expensed during the period they are incurred. In contrast, the full costing approach recognizes fixed manufacturing overhead costs as an expense when goods or services are sold.

Under full absorption costing, variable overhead and fixed overhead are included, meaning it allocates fixed overhead costs to each unit of a good produced in the period–whether the product was sold or not. The treatment of fixed overhead costs is different than variable costing, which does not include manufacturing overhead in the cost of each unit produced.

Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills. Having a more complete picture of cost per unit for a product line can be helpful to company management in evaluating profitability and determining prices for products. Absorption costing is a method for accumulating the costs associated with a production process and apportioning them to individual products. This type of costing is required by the accounting standards to create an inventory valuation that is stated in an organization’s balance sheet.

In contrast, the variable costing statement segments costs by variable expenses and fixed expenses. Variable expenses are subtracted from gross sales to arrive at contribution margin before finding net income. Marginal income statements make it easier for managers to understand product margins and production efficiency. However, absorption-style income statements are required by generally accepted accounting principles.

Absorbed cost, also known as absorption cost, is a managerial accounting method that accounts for the variable and fixed overhead costs of producing a particular product. Knowing the full cost of producing each unit enables manufacturers to price their products. That is why absorption costing is also referred to as full costing or the full absorption method. Another method of costing (known as direct costing or variable costing) does not assign the fixed manufacturing overhead costs to products. Therefore, direct costing is not acceptable for external financial and income tax accounting, but it can be valuable for managing the company.

Besides, absorption costing is also required by the Generally Accepted Accounting Principles (GAAP). Absorption costing and marginal costing income statements differ significantly in format. Both begin with gross sales and end with net operating income for the period. However, the absorption costing income statement first subtracts the cost of goods sold from sales to calculate gross margin. After that, selling and administrative expenses are subtracted to find net income.

Under this method, manufacturing overhead is incurred in the period that a product is produced. This addresses the issue of absorption costing that allows income to rise as production rises.

The supporters of variable costing argue that no fictitious profit can arise due to the fixed cost being absorbed in stock which is unsold. It’s important to note that period costs are not included in full absorption costing. In other words, a period cost is not included within the cost of goods sold (COGS) on the income statement. COGS are the costs directly involved in production, such as inventory. Instead, period costs are typically classified as selling, general and administrative (SG&A) expenses, whether variable or fixed.

By allocating fixed costs into the cost of producing a product, the costs can be hidden from a company’s income statement. Hence, absorption costing can be used as an accounting trick to temporarily increase a company’s profitability by moving fixed manufacturing overhead costs from the income statement to the balance sheet. In absorption costing, since a considerable amount of overhead costs are allocated to the product, a significant proportion of the product’s cost may not be directly traceable to the product. The management can also push forward costs to the subsequent period when the products are sold. Under absorption costing, managers can improve their profit performance by building up inventory.

and labor, but also both variable and fixed manufacturing overhead costs. This guide will show you what’s included, how to calculate it, and the advantages or disadvantages of using this accounting method.

- Under this method, manufacturing overhead is incurred in the period that a product is produced.

Choosing one method over another can have sizable effects on the reporting of financial statements. Absorption costing also known as ‘full costing’ is a conventional technique of ascertaining cost. It is the practice of charging all costs both variable and fixed to operations, processes and products. Under this technique of costing, cost is made up of direct costs plus overhead costs absorbed on some suitable basis.

What is absorption costing method?

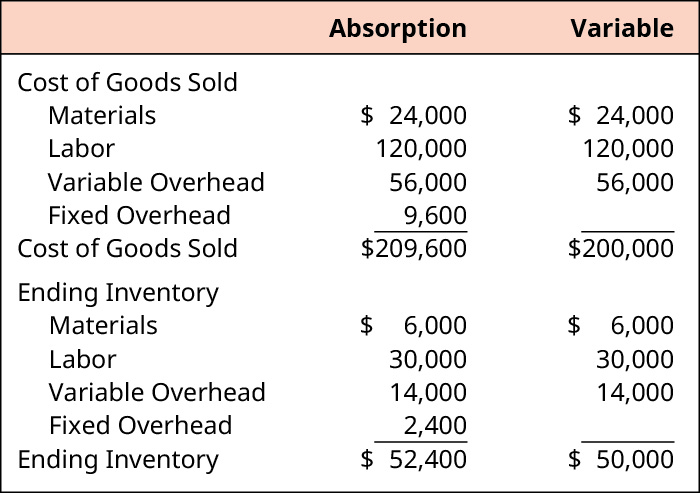

Under absorption costing, the cost per unit is direct materials, direct labor, variable overhead, and fixed overhead. In this case, the fixed overhead per unit is calculated by dividing total fixed overhead by the number of units produced (see absorption costing post for details).

How is absorption costing treated under GAAP?

However, fixed manufacturing overhead is a product cost under absorption costing and a period cost under marginal costing. The difference alters the cost of goods sold for the period, which often means a different net income figure for the period. Absorption costing takes into account all of the costs of production, not just the direct costs, as variable costing does.

How do you calculate absorption costing?

Absorption costing (also known as full absorption costing) indicates that all of the manufacturing costs have been assigned to (absorbed by) the units of goods produced. In other words, the cost of a finished product includes the following costs: direct materials. direct labor. variable manufacturing overhead.

Selling and administrative expenses are considered period costs under both costing systems. Both methods also classify direct materials, direct labor and marginal manufacturing overhead as product costs.

Definition of Absorption Costing

Since absorption costing is to be utilized for external reporting, it may be used as the sole method of accounting. Thus, an organization can completely do away with variable costing. But if it does so, it will miss out on certain key insights available from variable costing. Variable costing is not recognized for external reporting as it does not uphold the matching principle with regard to inventory. Undermatching principle, related expenses should be recognized in the same period as related revenue.

Example of Calculating the Cost of Goods Sold for the traditional income statement

These costs are not recognized as expenses in the month when an entity pays for them. Instead, they remain in inventory as an asset until such time as the inventory is sold; at that point, they are charged to the cost of goods sold.

What Does Absorption Costing Mean?

Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting. Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory. The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods. Absorption costing can skew a company’s profit level due to the fact that all fixed costs are not subtracted from revenue unless the products are sold.

Absorption costing and variable costing differ slightly in how they define product and period costs. When accountants look at the costs of running a business, they label them as either product costs or period costs. Product costs, also known as the cost of goods manufactured, are the costs directly associated with creating a good or service. Period costs are costs that the company incurs regardless of how much inventory it produces.