Absorption costing

How to Determine Variable Costs From Financial Statements

After that, selling and administrative expenses are subtracted to find net income. In contrast, the variable costing statement segments costs by variable expenses and fixed expenses.

Variable costing is generally not used for external reporting purposes. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP. Managers use variable costing to determine which products to offer and which products to discontinue. Rather than discontinuing a product based on negligible profits, a manager can use variable costing to determine the overall costs of keeping a unit in production.

The cost of setting up will be the same whether the printer produces one copy or 10,000. If the set-up cost is $55 and the printer produces 500 copies, each copy will carry 11 cents worth of the setup cost-;the fixed costs. But if 10,000 pages are printed, each page carries only 0.55 cents of set-up cost. The difference between fixed and variable costs is essential to know for your business’s future.

Absorption costing can cause a company’s profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold.

Variable costing is one method a company may use to complete this process. Under variable costing principles, direct materials, direct labor and variable manufacturing overhead represent the product’s cost. Fixed manufacturing overhead costs are a part of a company’s period expenses listed on the income statement. Variable costing is not allowable under generally accepted accounting principles as it violates proper accounting procedures for period expenses.

ACCOUNTING

In addition to skewing a profit and loss statement, this can potentially mislead both company management and investors. Economies of scale are another area of business that can only be understood within the framework of fixed and variable expenses. Economies of scale are possible because in most production operations the fixed costs are not related to production volume; variable costs are. Large production runs therefore “absorb” more of the fixed costs. Setting up the run requires burning a plate after a photographic process, mounting the plate on the printing press, adjusting ink flow, and running five or six pages to make sure everything is correctly set up.

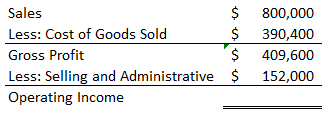

Absorption costing and marginal costing income statements differ significantly in format. Both begin with gross sales and end with net operating income for the period. However, the absorption costing income statement first subtracts the cost of goods sold from sales to calculate gross margin.

BUSINESS IDEAS

However, fixed manufacturing overhead is a product cost under absorption costing and a period cost under marginal costing. The difference alters the cost of goods sold for the period, which often means a different net income figure for the period.

When inventory levels fluctuate greatly, profits calculated under absorption costing may be distorted since inventory changes will influence the amount of fixed manufacturing overheads charged to an accounting period. It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced. The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy. In most cases, increasing production will make each additional unit more profitable. This is because fixed costs are now being spread thinner across a larger production volume.

Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero.

This will give you an idea of how much of costs are variable costs. You can then compare this figure to historical variable cost data to track variable cost per units increases or decreases. Cost accounting provides a company with measurement and allocation techniques to compute a good’s production cost.

Product costs, also known as the cost of goods manufactured, are the costs directly associated with creating a good or service. Period costs are costs that the company incurs regardless of how much inventory it produces. Selling and administrative expenses are considered period costs under both costing systems. Both methods also classify direct materials, direct labor and marginal manufacturing overhead as product costs.

- It is important to understand the behavior of the different types of expenses as production or sales volume increases.

How do you find net income from variable costing?

Variable costs are explicitly labeled on a variable costing income statement. Under sales revenue, there should be a line item labeled “Cost of Goods Sold” and “Variable Selling, General and Administrative Expenses”. Sum these two line items to determine total variable costs.

For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). Absorption costing takes into account all of the costs of production, not just the direct costs, as variable costing does. Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills. Having a more complete picture of cost per unit for a product line can be helpful to company management in evaluating profitability and determining prices for products.

A business is sometimes deliberately structured to have a higher proportion of fixed costs than variable costs, so that it generates more profit per unit produced. Of course, this concept only generates outsized profits after all fixed costs for a period have been offset by sales.

On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100. Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged. For example, if the bicycle company incurred variable costs of $200 per unit, total variable costs would be $200 if only one bike was produced and $2,000 if 10 bikes were produced. However, variable costs applied per unit would be $200 for both the first and the tenth bike. The company’s total costs are a combination of the fixed and variable costs.

For example, if a business that produces 500,000 units per years spends $50,000 per year in rent, rent costs are allocated to each unit at $0.10 per unit. If production doubles, rent is now allocated at only $0.05 per unit, leaving more room for profit on each sale.

Under this method, manufacturing overhead is incurred in the period that a product is produced. This addresses the issue of absorption costing that allows income to rise as production rises. Under an absorption cost method, management can push forward costs to the next period when products are sold. This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system.

Where are variable costs on income statement?

What is Variable Costing Income Statement? Variable costing income statement is one where all variable expenses are subtracted from revenue which results to contribution margin, from this all fixed expense are then subtracted to arrive at the net profit or loss for the period.

It is important to understand the behavior of the different types of expenses as production or sales volume increases. Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline. For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike.

If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time.

Examples of Variable Costing Income Statement

Subtract total variable costs from gross sales to find the contribution margin for the period. Subtract fixed manufacturing overhead and fixed selling and administrative expenses to arrive at net operating income for the period. Absorption costing and variable costing differ slightly in how they define product and period costs. When accountants look at the costs of running a business, they label them as either product costs or period costs.

For example, if a company offers four products and decides to discontinue two, the two remaining products have to absorb higher overhead expenses. Variable costing illustrates the impact that discontinuing a product has on all costs related to production. When considering variable costing, managers logically see that keeping a particular unit in production helps absorb fixed costs and maintain overall profitability. The fixed costs of sales and production remain the same for a given period of time.

Variable expenses are subtracted from gross sales to arrive at contribution margin before finding net income. Marginal income statements make it easier for managers to understand product margins and production efficiency. However, absorption-style income statements are required by generally accepted accounting principles.

In variable costing, profit is a function of sales volume only. But under absorption costing sales and production (production creates inventory) both influence profit of a period. Profit in variable costing is not affected by changes in inventory as it is in absorption costing. In absorption costing, profit may decline although sales have increased.

Absorption costing fails to provide as good an analysis of cost and volume as variable costing does. If fixed costs are an especially large part of total production costs, it is difficult to determine variations in costs that occur at different production levels. This makes it more difficult for management to make the best decisions for operational efficiency.

Managers who consider variable costing to sell additional units during a specific time frame add to the company’s bottom line in sales and profits because the units do not cost the company more money to produce. Variable costing does not take into account fixed or absorption costs; therefore profits are likely to increase by the amount earned through the sale of the additional item. As with the absorption costing income statement, you begin a marginal costing income statement by calculating gross sales for the period. Next, you calculate variable cost of goods sold and variable selling expenses. To calculate variable cost of goods sold, start with beginning inventory, add variable manufacturing costs and subtract ending inventory.