Redondo Beach QuickBooks Accountant

This process ensures all cash items clear the company’s bank account in a timely manner. It also prevents the company’s general ledger from becoming clogged with inaccurate or irrelevant information. Cash accounts with significant inaccuracies can mislead business owners into believing the company has better cash flow than it really does. A bank reconciliation should be completed at regular intervals for all bank accounts, to ensure that a company’s cash records are correct.

Because most companies write hundreds of checks each month and make many deposits, reconciling the amounts on the company’s books with the amounts on the bank statement can be time consuming. The process is complicated because some items appear in the company’s Cash account in one month, but appear on the bank statement in a different month.

At the end of this process, the adjusted bank balance should equal the company’s ending adjusted cash balance. Because all checks that have been written are immediately recorded in the company’s Cash account, there is no need to adjust the company’s records for the outstanding checks. However, the outstanding checks have not yet reached the bank and the bank statement. Therefore, outstanding checks are listed on the bank reconciliation as a decrease in the balance per bank.

For example, a bank service charge might be deducted on the bank statement on August 31, but the company will not learn of the amount until the company receives the bank statement in early September. From these two examples, you can understand why there will likely be a difference in the balance on the bank statement vs. the balance in the Cash account on the company’s books.

A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate. The information on the bank statement is the bank’s record of all transactions impacting the entity’s bank account during the past month. Bank reconciliation is the comparison of your monthly bank statement to your internal accounting records. You need to make sure that the closing amount on your bank statement matches the closing balance on your accounting records.

COMPARE THE DEPOSITS

A bank reconciliation statement is a useful financial internal control tool used to thwart fraud. The following format is typical of one used in the reconciliation process. Note that the balance per the bank statement is reconciled to the “correct” amount of cash; likewise, the balance per company records is reconciled to the “correct” amount. Imagine you buy a train ticket for a business trip on your company debit card. When you see this transaction appear on your bank statement, you will need to record it in your accounting records.

For example, checks written near the end of August are deducted immediately on the company’s books, but those checks will likely clear the bank account in early September. Sometimes the bank decreases the company’s bank account without informing the company of the amount.

However, deposits in transit are not yet on the bank statement. Therefore, they need to be listed on the bank reconciliation as an increase to the balance per bank in order to report the true amount of cash. Below the ending balance per the bank statement, create a detailed list of deposits in transit – a deposit that was made but not yet recorded by the bank. Include in your list the date the deposit was made, from whom the check was received and the method of deposit. The first step in a bank reconciliation is to adjust the balance reported by your bank.

These are transactions in which payment is en route but the cash has not yet been accepted by the recipient. When preparing the Oct. 31 bank reconciliation statement, the check mailed the previous day is unlikely to have been cashed, so the accountant deducts the amount from the bank balance. There may also be collected payments that have not yet been processed by the bank, which requires a positive adjustment. A company’s general ledger account Cash contains a record of the transactions (checks written, receipts from customers, etc.) that involve its checking account.

How Do You Reconcile a Bank Statement?

Your goal is to reconcile any differences between the bank balance and your cash account records. Bank reconciliation is rarely something most small business owners and entrepreneurs want to do. It is, however, essential to keeping the financial aspects of a business running smoothly.

What Is the Purpose of Bank Reconciliation?

- A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement.

It is also possible (perhaps likely) that neither balance is the true balance. Both balances may need adjustment in order to report the true amount of cash. The accountant adjusts the ending balance of the bank statement to reflect outstanding checks or withdrawals.

Bank reconciliation steps

This part of the reconciliation ensures all items recorded in the general ledger have cleared the company’s bank account. Once an item clears the bank account, it usually represents the finality of that particular business transaction. A business must track its funds to have a clear picture of its financial health. Bank statement reconciliations are an tool that business owner’s use in a proper cash management process. This procedure compares the account balance, as reported by the bank, against the account register in the company’s general ledger.

A bank reconciliation is the process of matching transactions in your bank statement (Imported Transactions) to those in your accounting software (entered transactions). Traditionally this was done using a physical bank statement you’d get in the mail once a month. Nowadays, a bank feed can be set up to import your bank transactions into your accounting software on a daily basis. A bank reconciliation statement is a summary of banking and business activity that reconciles an entity’s bank account with its financial records. The statement outlines the deposits, withdrawals and other activities affecting a bank account for a specific period.

If you don’t do so, your records will show a different figure to your bank account. This process of recording and matching transactions from your accounting records to your banking records is bank reconciliation. Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds. If this occurs at month-end, the deposit will not appear in the bank statement, and so becomes a reconciling item in the bank reconciliation. Then, go to the company’s ending cash balance and deduct from it any bank service fees, NSF checks and penalties, and add to it any interest earned.

Compare the adjusted bank statement balance per your reconciliation to the adjusted cash balance per the general ledger. Bank reconciliations can help a company to verify that its bank account ending balance per the bank matches the balance on hand per the company’s general ledger.

For instance, a bank may charge a fee for having the account open. The bank typically withdraws and processes the fees automatically from the bank account. Therefore, when preparing a bank reconciliation statement, any fees taken from the account must be accounted for by preparing a journal entry. The company checks this statement against its records to determine if it must make any corrections or adjustments in either the company’s balance or the bank’s balance. The company prepares a bank reconciliation to determine its actual cash balance and prepare any entries to correct the cash balance in the ledger.

The bank also creates a record of the company’s checking account when it processes the company’s checks, deposits, service charges, and other items. Soon after each month ends the bank usually mails a bank statement to the company. The bank statement lists the activity in the bank account during the recent month as well as the balance in the bank account. When your company receives the bank statement, you should print a report listing all of the checks written and deposits made during the month.

Otherwise, it may find that cash balances are much lower than expected, resulting in bounced checks or overdraft fees. A bank reconciliation will also detect some types of fraud after the fact; this information can be used to design better controls over the receipt and payment of cash. Because deposits in transit are already included in the company’s Cash account, there is no need to adjust the company’s records.

A bank reconciliation is a critical tool for managing your cash balance. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement.

Don’t be immediately alarmed if you discover a discrepancy as it could be a simple oversight, unaccounted for bank service fees, or outstanding checks. Whatever the reason may be, you need to identify and properly resolve the issue.

A company will probably have accounting software that can provide reports.If you’re reconciling your personal bank account, you should review your check register and your deposit slips. A company should print the cash reports, and also review the check register and deposit slips. The balance of the cash account in an entity’s financial records may require adjusting as well.

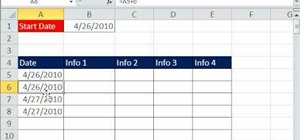

Bank reconciliation is the process of reconciling your bookkeeping records with your bank statement. It includes all expenditures and deposits during a specific time period. Start the bank reconciliation process with a comparison of the company’s bank statement and general ledger cash account.

To prepare a bank reconciliation, gather your bank statement and a list of all of your recent transactions. Compare your debits, or withdrawals from your bank account, and credits, or deposits you made into your account, to ensure that the transactions appear in both your records and on your bank statement. If you find an error on the bank’s part, contact them as soon as possible to let them know about the discrepancy. If you have online access to your account, your bank statement should be available shortly after that last day of the month. When you get the statement, note the month-end balance.