5 Types of Market Segmentation & How To Use Them

It may also be beneficial to discuss cash flows by segment if there are specific limitations, restrictions, or funding requirements. Segment disclosures are intended to provide a view of the business through the eyes of management. This information can help financial statement users to enhance their understanding of a company’s performance, better assess its prospects for future net cash flows and make more informed judgments about the company as a whole. Segment reporting is the reporting of the operating segments or units of a company in its financial statements.

Segmentation analysis helps a company to understand its customers’ demographics and their motivations for buying particular products. Small businesses can follow the examples of market segmentation techniques of other companies to design their own ways of better understanding a target market. Think about how many data sources and which destinations you use to help determine if Segment is an option for your organization. Remember that other tag managers also offer common native integrations.

Segment reporting is required for publicly held entities, but not required for privately held ones. A business segment is a portion of a business that generates revenue from selling a product or a line of products, or by providing a service that is separate from the primary line of focus for the business. For accounting purposes, FASB’s SFAS 131 is the definitive source when it comes to accounting practices involving segments. Credit card companies often segment their target market based on the various types of cards they are offering. Some cards are geared toward higher-income customers, others to those who are looking for cash back or rewards and still others to those who want to build their credit score.

For example, disclosures could explain that the segments have changed as a result of an acquisition or expansion into a new product or new geography. While the standard allows aggregation into reportable segments under certain circumstances, users have indicated that they would generally find more disaggregated information beneficial. As such, companies can consider whether voluntarily disaggregating their reporting segments into the operating segment level would provide useful information.

A segmented income statement is a managerial accounting tool that breaks the income statement down into different categories. It could be a manufacturing company that produces and sells different types of goods, or a retail company that has different product segments. It breaks down the revenue, cogs, and if possible operational costs between the products or divisions. Another type could be if a large company has many different divisions or types of operating income under one parent company they could segment the income statement between those divisions. It allows management to analyze cost and profit within the company for operational performance.

Segmented accounting divides a company’s financial performance into pieces. A company can be segmented in many ways, including physical location, products or areas of responsibility. Comparing segments of a business helps a company analyze company performance more accurately. Generally accepted accounting principles in the United States require large segments to be reported in the financial statements of public companies so investors can also assess the business more accurately. In financial reporting, a segment is a part of the business that has separate financial information and a separate management strategy.

The disclosures are based on “management’s approach,” and are intended to provide stakeholders with a view of the business through the eyes of management. As a result, a company’s operating segments may be based on the nature of the business activities, the regulatory environment, the geographies in which it operates, or some combination of factors. Operating segments are based on how the CODM views the business, therefore, the segments and the segment performance metrics may not be comparable with peer companies.

Pull data that shows how much customers spend, how often they visit your store, and the type of products and services they buy. Management Discussion & Analysis (MD&A)– Companies are required to provide an analysis of the consolidated financial condition, operating performance and liquidity of the company. This disclosure should include segment information when it is material to understand the consolidated financial results. Enhanced disclosures by segment may be meaningful when a segment is impacted by a significant acquisition or disposition, material non-recurring gains or losses, or other trends that are different from the consolidated trends.

AccountingTools

If your organization is invested in the Adobe Experience Cloud or the Google Marketing Platform, Launch or GTM are probably better options for you. If your company is more dependent on a data warehouse and a mix of marketing tools, Segment could be a good option. It serves as a connector between your data sources and where you ultimately want to send your data. The goal is to use the same code base for all of your different destinations.

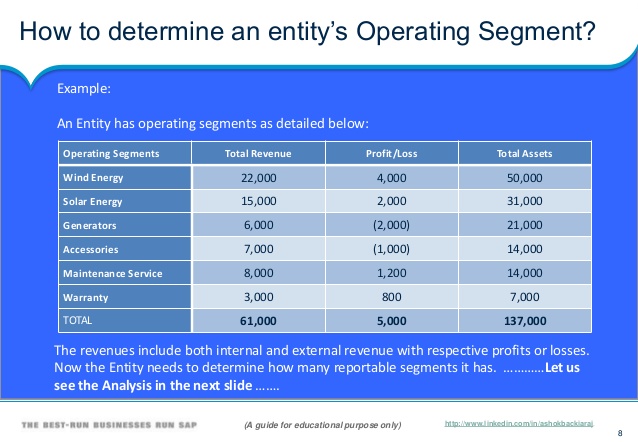

When certain conditions are present, the segment reporting standard allows a company to aggregate its operating segments into reportable segments for financial statement disclosure. To aggregate operating segments, the segments must have similar economic characteristics and similar products or services, customers, distribution methods, production processes, and regulatory environments.

Publicly traded businesses that prepare their financial statements in accordance with international accounting standards must disclose information about each of their reportable segments. This means that each segment’s activities must be listed separately as well as included in the business’s overall performance data.

- The disclosures are based on “management’s approach,” and are intended to provide stakeholders with a view of the business through the eyes of management.

- When certain conditions are present, the segment reporting standard allows a company to aggregate its operating segments into reportable segments for financial statement disclosure.

START YOUR BUSINESS

A study by the marketing firm Dun and Bradstreet found that more than one-third of a given market consists of “innovators” — consumers who are interested in broad services and who display extreme loyalty to a company. The same study found that around 17 percent of a given market consists of “traditionalists” who prefer to remain risk averse. Credit card companies can use such data to target their marketing and promotion to specific consumers based on which category they fall into.

These disclosures must discuss why each listed segment qualifies as reportable. The business must provide how much income and expenses the segment generated.

Why is segment reporting important?

Segment reporting is the reporting of the operating segments of a company in the disclosures accompanying its financial statements. Segment reporting is required for publicly-held entities, and is not required for privately held ones.

Public companies are required to report by segment in the notes of financial statements. Management accounting often reviews the company by segment to determine which areas or lines are working better than others. Information is based on internal management reports, both in the identification of operating segments and measurement of disclosed segment information. Segment disclosures included in the notes to the financial statements provide users with insights into how the chief operating decision maker (CODM) allocates resources and assesses the performance of the company’s segments.

ACCOUNTING

The business also must separately list all of the assets and liabilities specifically tied to the reportable segment. Similarly for companies that realign their segments, meaningful disclosures as to the reasons for the change may help users understand what has happened in the underlying business that warrants a change in segments.

Of course, there are other considerations when choosing a tag management system. In this post, we’ll cover the basics of Segment and what you should consider before choosing it as your tag management solution. Segment disclosures are intended to provide a view of the business through the eyes of management, and provide insight into how management has structured the company to monitor and manage its businesses.

Segment reporting is the reporting of the operating segments of a company in the disclosures accompanying its financial statements. Segment reporting is required for publicly-held entities, and is not required for privately held ones. Your business likely has loads of data that can help you get to know your customers. Use your customer relationship management tools and point-of-sale systems to find trends related to behavioral segmentation.

Segment collects hits from your single code base and then sends them off to your various analytics and marketing tools. Segment can be a good option for companies that are sending data to several databases and integrating with lots of different marketing tools.

MANAGEMENT

Market segmentation is the process of analyzing the appropriate consumers to which a product should be targeted. It’s about dividing broad target markets into subsets of consumers with similar wants and needs.