5 Things a Comptroller Does

The major difference between the requirements for a controller and an accountant is that the controller is a manager, and their focus in school will be in both finance and business administration. If you start in the field of accounting as an accountant, your experience may replace the need for an MBA. At the end of the day, the controller vs comptroller relationship is not all too diverse. A controller is a person that is at the highest accounting level in an organization.

The Certified Public Accountant (CPA) credential is commonly required for CONTROLLER positions. Requirements for a CPA differ by state, but majority require a minimum of 150 semester hours of undergraduate education, which is usually around 30 credits more than a bachelor’s degree. Additionally, those wanting to take the examination need at least one year of experience in accounting.

Every controller job is unique, but there are universal skills and qualifications that any serious candidate should possess. Most openings also require a master’s of business administration (MBA) or a certified public accountant (CPA) designation, or both. Controllers tend to make more money and have to manage people and organize departments; not all accountants have the same responsibility.

In other words, he/she is the head of the financial division of a company. Controllers are responsible for the financial accounting reporting, analysis and interpretation to the executive management team. There is not a significant difference in the roles of a controller versus comptroller. A comptroller definition is a senior accountant in a government organization, however, the duties of a comptroller and controller do not differ.

As the Chief Accounting Officer of an organization, the controller, often called a comptroller, is also responsible for complying with tax laws and government reporting requirements. CONTROLLERS need a strong background in financial management or related area, and many employers require at least five years work experience. Many individuals start out as cost accountants and advance to accounting management positions after showing financial expertise and leadership abilities. Some CONTROLLERS first work as assistant CONTROLLERS to gain an understanding of job duties and demonstrate their abilities to advance. In general, at least a bachelor’s degree in finance, business administration, accounting, or related area is required for CONTROLLER positions.

A career as a CONTROLLER is typically very lucrative, as theBureau of Labor Statisticsreports these individuals earning a median pay of $109,740 per year. The top industries for these professionals include professional, scientific, and technical services and management of companies and enterprises. The career outlook is projected to increase as fast as average for all jobs over the next decade. With the right education, experience, and certification, a CONTROLLER position is a great career choice.

Other controllers work for the government and are akin to chief financial officers (CFOs) for their respective agencies. It’s better to look at experienced accountants (even managers or other senior-level positions) when making comparisons to controllers. Entry-level accountancy jobs may be perfectly fine, but the vast majority of controllers have years of experience and several professional certifications.

Determine the Value of a Controller vs CFO

However, there seems to be a slight difference between the two entities when examined at a closer level. Life as an accountant isn’t particularly glamorous, but few career paths match its combination of solid pay, low stress, job security, and opportunity for advancement.

The CPA examination contains four sections, including business environment and concepts, auditing and attestation, regulation, and financial accounting and reporting. Many CONTROLLERS also pursue voluntary certifications, including Chartered Financial Analyst (CFA) and Certified Management Accountant (CMA). These certifications commonly require the passing of several examinations. To maintain CPA licensure and related certifications, CONTROLLERS are typically required to complete continuing education. Qualified finance managers and controllers work in organizations of all kinds.

Few accountants ever worry about burning out or feel compelled to switch industries, and many will move into positions of prominence and importance in an organization. One such position is the controller (sometimes spelled “comptroller,” but always pronounced “controller”), who is the person responsible for a firm’s accounting-related activities. Comptrollers also need a four-year bachelor’s degree in accounting, business administration, management or finance.

Some people thrive in management roles, and these are the best candidates for controller jobs. Others are happiest as experts in their own fields without the complications of oversight. This should be a major factor when deciding about a potential controller career. A common yet underappreciated role of the business controller is interpreting financial data. Controllers typically have a great deal of accounting and business forecasting experience, particularly as it pertains to tax management.

The median annual pay for financial controllers was $79,782 in April 2018, based on PayScale.com’s salary surveys. Senior-level accountancy jobs require a CPA designation and maybe even a certified management accountant (CMA), chartered financial analyst (CFA), or other professional designation. Senior financial accounting and reporting jobs might need three to six years of work experience, while tax accountants or junior auditors might only need one to three years after passing the CPA exams. The educational requirements to become an accountant do not differ much from the requirements to become a controller. In order to become an accountant, you will need to pursue a 4-year undergraduate degree in accounting.

Almost all controllers start out as public accountants or work in corporate settings before moving up. Accountants may choose to specialize in such areas as tax services, consulting or auditing. While accountants may opt to go in business for themselves, comptrollers work for government agencies or large corporations. In a corporate setting, the difference between an accountant and a comptroller is that the comptroller is the head of the accounting department. Large private companies or government agencies may employ many accountants to balance books or prepare budgets and financial reports.

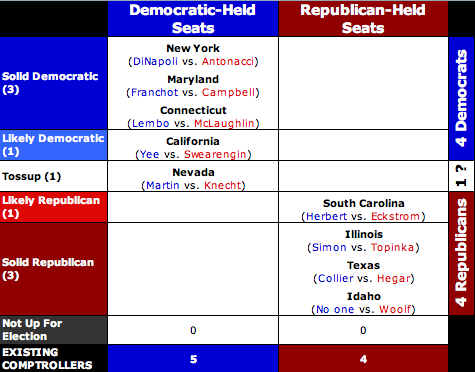

United States

- The Certified Public Accountant (CPA) credential is commonly required for CONTROLLER positions.

A main function for a controller is the preparation of financial reports that summarize or forecast an organization’s financial position. On some occasions, the controller would assist his company’s outside auditors when they prepare an annual report. The controller would also be responsible for preparing special reports for regulators, governmental agencies and banks. Generally, the controller oversees a company’s accounting function and conducts internal audits. In most cases, the controller’s reports are prepared for the company’s executive management team.

Some companies also require job candidates to be certified public accountants and/or have a master’s degree in business administration, or MBA. At the top of the hierarchy of accounting positions is a chief financial officer or a vice president of accounting or finance. This person is responsible for evaluating your company’s past financial information and sharing it with you, your senior management, and other important members of your team, such as stockholders and investors. The CFO must also accurately present information about your company’s current financial status, so that you can decide how much debt and equity your business has generated.

AccountingTools

Banks, investment firms and insurance companies tend to employ these financial professionals at all levels. Nonprofit organizations, with their many fundraising activities and grant programs, must devote much of their time to accounting and financial reporting. Businesses of all sizes employ bookkeepers, other financial staff and accountants to compile financial statements and work on tax reporting. Finance managers and controllers also work in federal, state and local government offices. The easiest way to distinguish between an accountant and a controller is to understand what each does in the accounting department.

Government role

Once you earn your bachelor’s degree, you may want to go a step further and study to take the Certified Public Accountants exam to earn your CPA certification. In addition to this, you will need either a CPA or a MBA to compete for a position.

Basically speaking, an accountant is in charge of preparing financial reports and analyzing how the company is performing financially. A controller on the other hand, is in charge of the accounting department and will oversee the production of financial reports as well as control the company’s cash flow. Controllers are in charge of money and accountants, and accountants are responsible for keeping tabs on where the money is going.

Bachelor’s degrees in these areas provide individuals with a strong business and financial background, and the ability to make sound decisions in the field. Many programs involve instruction in economics, managerial accounting, business law, financial management, human resources, international business, budget analysis, and taxation. A lot of programs include internship and externship opportunities to provide students with the ability to gain hands-on experience in the field. Some employers prefer a master’s degree in business administration or similar field. A master’s degree in this area provide complex instruction in financial strategy and helps individuals develop strong leadership skills.

A controller may also be called on to lend his or her expertise on investments, creditor relationships, corporate governance, or other areas. The most common are business controllers and corporate controllers, who handle entire accounting systems for their employers. For smaller companies, this means setting up the accounting infrastructure and performing the bookkeeping, whereas larger companies use controllers in an overseer role.

What does the comptroller do?

This etymology explains why the name is often pronounced identically to “controller” despite the distinct spelling. However, comptroller is sometimes pronounced phonetically by those unaware of the word’s origins or who wish specifically to avoid confusion with “controller.”

Those interested in pursuing a career as a CONTROLLER often inquire about the educational and professional requirements. The primary requirements include a minimum of bachelor’s degree, finance experience, licensure and certification, and personal abilities.

In such a scenario, the comptroller would oversee the daily activities of the accounting department and report to the chief financial officer, or CFO. Accountants and financial analysts are at the next to last level of the accounting career hierarchy.

Accountants have direct responsibility for their field of expertise, which includes analysis, reporting, payroll, invoicing, accounts payables, account receivables, and vendor qualification. In larger companies, these duties are separated because of the volume of work involved. Accountants and financial analysts do the day-to-day work necessary to keep your company’s books in order.

A CONTROLLER is a valuable employee to nearly all businesses and organizations. These individuals are responsible for the financial reporting and related tasks, including evaluating expenses and analyzing the entity’s financial position under specific regulatory guidelines. CONTROLLERS also manage other employees in accounting and auditing departments.

Is Comptroller pronounced controller?

The controller and comptroller titles refer to the same position, which is the person responsible for all accounting operations of a business. The controller title is more frequently found in for-profit businesses, while the comptroller title is more commonly found in governmental and non-profit organizations.