5 Accounting Principles

These are the three statements that made up your financial statements for month end reporting. As technology advanced and people got smarter about tracking trends, analysis, and operations today, the month end report includes much more.

While business owners can use a variety of internal accounting reports for business decision purposes, financial statements are usually the final output of the company’s accounting process. Financial statements report the aggregate total of financial information included in the company’s general ledger. The income statement is one of the financial statements of an entity that reports three main financial information of an entity for a specific period of time.

What is financial reporting?

To see how these two methods can result in totally different financial statements, imagine that a carpenter contracts a job with a total cost to the customer of $2,000. The carpenter’s expected expenses for the supplies, labor, and other necessities are $1,200, so his expected profit is $800. He contracts the work on December 23, 2004, and completes the job on December 31, 2004.

In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers. The income statement is the primary financial statement for small business owners.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

These include profit and loss statements, balance sheets, cash flow statements and budgets. This report reveals the financial performance of an organization for the entire reporting period. It begins with sales, and then subtracts out all expenses incurred during the period to arrive at a net profit or loss. An earnings per share figure may also be added if the financial statements are being issued by a publicly-held company. This is usually considered the most important financial statement, since it describes performance.

What do you mean by financial reporting?

Financial reporting includes the following: External financial statements (income statement, statement of comprehensive income, balance sheet, statement of cash flows, and statement of stockholders’ equity) The notes to the financial statements. Quarterly and annual reports to stockholders.

Therefore, operating results during the period also concerns investors. The financial statement of income statement reports operating results such as sales, expenses and profits or losses. Using the income statement, investors can both evaluate a company’s past income performance and assess the uncertainty of future cash flows. This is a statement that shows physical money moving in and out of your business. You base your cash flow statement partly on your sales forecasts, balance sheet items and other assumptions.

Existing business should have historical financial statements to use to project their cash flow. New businesses should start by projecting cash flow statement that is broken down into 12 months.

To get these projections is important to know how you will be invoicing. Will you expect your customers to pay right away or within 30 to 90 days? You don’t want to be surprised that you only collect 70 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses.

- Therefore, operating results during the period also concerns investors.

- Using the income statement, investors can both evaluate a company’s past income performance and assess the uncertainty of future cash flows.

In this week’s blog, I answer the question, what should your month end reports contain?. The income statement, balance sheet and cash flow statement are the three most common financial statements. Business owners use each statement to analyze various pieces of their company’s financial information. Smaller or home-based businesses using cash basis accounting methods will not have a cash flow statement.

Financial Reporting

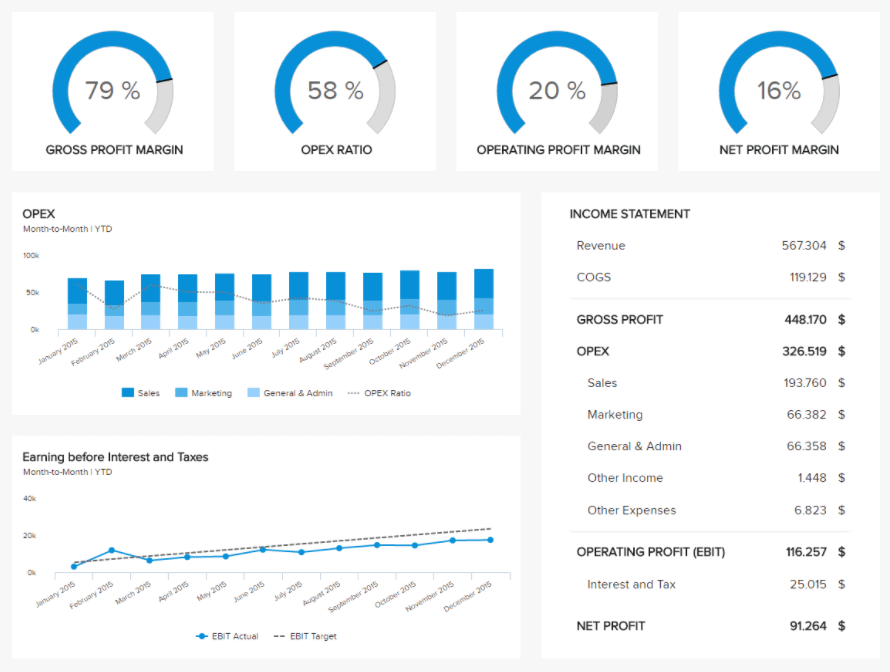

The income statement lists all sales revenues, cost of goods sold and expenses for specific time period. Most income statements represent this information in a vertical format. Sales revenue is first, cost of goods sold second and expenses third on the financial statement. Sales revenue less cost of goods sold is the company’s gross profit. Gross profit less the monthly expenses leaves net income as the income statement’s final number.

Some business planning software programs will have these formulas built in to help you make these projections. For example, if a painter completed a project on December 30, 2003, but doesn’t get paid for it until the owner inspects it on January 10, 2004, the painter reports those cash earnings on her 2004 tax report.

Those information included revenues, expenses, and profit or loss for the period of time. The company profits reported in the income statement can be difficult to interpret and most likely contain certain non-cash elements, providing no direct information on a company’s cash exchange during the period. Financial management starts with recording all the money your business earns and spends. Accountants then prepare reports that help owners understand the financial health of their business.

Financial reporting and analysis consists of the records you compile to track business funds. Recognize items such as assets, liabilities, owner’s equity, income, and business expenses in your financial reporting standards. A balance shows the assets, liabilities and shareholder equity during a specific period. On the right side of the page list your liabilities including accounts payable, credit card balances, bank loans and any other money your company owes.

What is included in financial reporting?

Financial reporting is the disclosure of financial results and related information to management and external stakeholders (e.g., investors, customers, regulators) about how a company is performing over a specific period of time.

Cash flow statements are only used by companies using the accrual accounting method. Cash basis accounting accurately reports cash for the business owner, making the cash flow statement redundant. Business owners often use accounting to measure their company’s financial performance. Accounting is responsible for recording and reporting a company’s financial transactions.

Income Statement or Profit and Loss Report – reports on a company’s income, expenses, and profits over a period of time, such as a fiscal quarter or year. This includes sales and the various expenses incurred during the stated period.

Finally, total your assets and liabilities and then subtract your liabilities from your assets. Back in the day, month end reports consisted of a income statement, balance sheet, and maybe a cash flow statement.