3 Ways to Endorse a Check

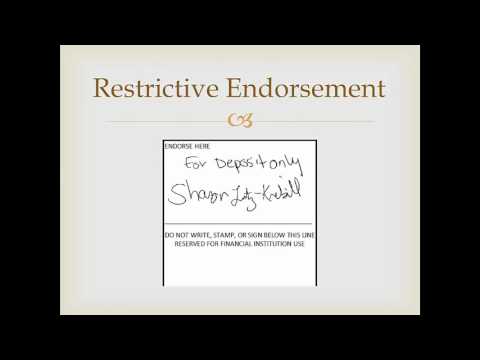

To do so, write “For deposit only to account #####” (using your account number), as part of your endorsement. If the check is lost or stolen, it’s more difficult for thieves to get the money—they’ll need to alter the endorsement.

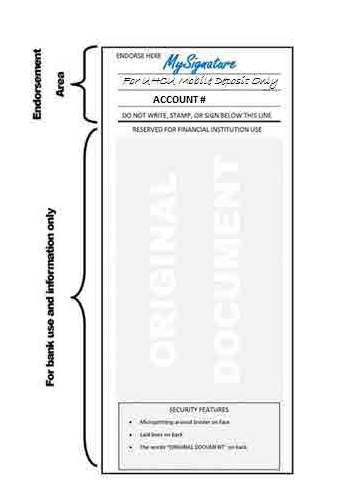

No Endorsement

To sign a check over to somebody else or to a business, verify that a bank will accept the check, thenendorse the back of the check by signing it. To successfully endorse a check, sign your name on 1 of the grey lines located on the back of the check. Make sure the name you sign matches the name on the front of the check, even if the person who wrote the check misspelled or abbreviated it. If you plan to deposit your check, put “For Deposit Only” on the top endorsement line and write your bank’s name and your account number on the line below your signature.

Even if you cash a check, a hold will often be placed on an equivalent amount of money in your account. Once the money is deducted from the check writer’s account, the hold is lifted. Processing time varies, but it is usually no more than a few business days. However, if the amount of the check is greater than the funds in the check writer’s account, the check may bounce.

If you endorse checks and then they get lost, it’s easier for somebody else to cash the check or try and deposit the check intheiraccount. Banks and credit unions regularly accept unendorsed checks and assume that no problems will arise. When you get paid with a check, that payment is made toyou. You’re the only person who can legally collect money from the checkwriter’s account. However, the easiest way tocash that check(or money you can spend from yourchecking account) is to hand it over to your bank and letthemdeal with it.

Most checks have a 1.5-inch section for you to write in. Although some checks have a preprinted box to indicate mobile deposit, checking this box does not complete the endorsement requirement. “For Mobile Deposit Only” must be written legibly below your signature.

The most common restrictive endorsement- “For Deposit only” followed by a signature-means that a check can only be deposited into the account of the endorser, not cashed. When you deposit a check, it is common for all or part of the funds to be placed on hold (unavailable for withdrawal) while the check is being processed.

Some banks allow you to deposit checks without a signature, account number, or anything else on the back. Skipping the endorsement can help keep your information private. Checkwriters can often view images online of processed checks, including the endorsement area, after checks are paid. With no endorsement, nobody can see your signature or your account number unless your bank adds the account number during processing. The “for deposit only” endorsement is added to the back of a check in order to restrict the payment of the check to the endorser.

How to Endorse

- To sign a check over to somebody else or to a business, verify that a bank will accept the check, thenendorse the back of the check by signing it.

- To successfully endorse a check, sign your name on 1 of the grey lines located on the back of the check.

Most banks require additional signatures to allow a third party to deposit the funds. Banks don’t have to accept checks signed over to someone else (called “third-party checks”), and many banks refuse them. Before you sign your check over to someone else, call the bank where the person is going to take the check and make sure they accept checks endorsed this way. No matter what method you use to endorse checks, wait as long as you can before signing a check. It’s best to sign while you’reatthe bank or you’re in the process of making a mobile deposit.

Through your endorsement, you give the bank the legal right to process the check. You can simply sign the check with your name only, add restrictions for how the bank should process the check, or sign the check over to someone else.

How do you write a check for deposit only?

No Endorsement You don’t always have to endorse checks. Some banks allow you to deposit checks without a signature, account number, or anything else on the back. For extra security, you can still write “for deposit only” in the endorsement area.

A blank endorsement is when someone signs the back of a check that does not indicate a particular payee. The person who wrote the check is considered the remitter. Once endorsed, the check can be cashed by anyone who wishes to claim it. People can also write a check to themselves as cash, and cash it. Yes, you can deposit the check in your account if the payee on the company check is in your cousin’s name and he subsequently endorses the check over to you.

For extra security, you can still write “for deposit only” in the endorsement area. Technically that’s not an endorsement, but most banks and credit unions would be reluctant to cash that check for anyone.

Restrictive Endorsement—Get Money Into Your Account

The maid could take the check and deposit it into his or her account. It’s always a good idea to play safe and only sign the check right before cashing or depositing. Every check needs to be properly signed before someone can cash or deposit it.

Do I need to write for deposit only?

The “for deposit only” endorsement is added to the back of a check in order to restrict the payment of the check to the endorser. Conversely, if the payee is hand-carrying the check to a bank, there is less need to use this restrictive endorsement.

For deposit only endorsement

If this happens, you will not get the money from the check. In addition, your financial institution may charge you a fee. If your friend is the only one who signs the check, the bank typically won’t allow them to deposit the money into their account.

Writing this type of wording onto the back of a check ensures that funds cannot be diverted elsewhere. Blank endorsement is one of the most typical endorsements, and it consists of a person signing the back of a check that does not indicate a payee. The payee endorses the check and then goes to cash or deposit it after being properly verified by the bank official. The back of the check is usually blank and has a line for signing. There is one line on the back of the check, and above the line it says, ‘endorse check here.’ It doesn’t read ‘for deposit only’ or ‘to be payable to so and so.’ It is simply blank.

For example, he would write on the back of the check “Pay to the order of [your name]” and sign his name. when depositing the check, you would write your name under the endorsement. If someone gives you a check, you must endorse it before you can cash it or deposit it in your bank account.